Both Portfolio Y and Portfolio Z are well diversified. The risk-free rate is 6%, the expected return

Question:

Both Portfolio Y and Portfolio Z are well diversified. The risk-free rate is 6%, the expected return on the market is 15%, and the portfolios have these characteristics:

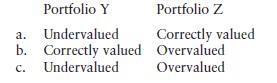

Which of the following best characterizes the valuations of Portfolio Y and Portfolio Z?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Question Posted: