a. Explain what is meant by a long position in futures and what is meant by a

Question:

a. Explain what is meant by a long position in futures and what is meant by a short position in futures.

b. Suppose a hedger employs a futures hedge that is two-thirds the size of the underlying position. Why do you think this is called a “partial” hedge?

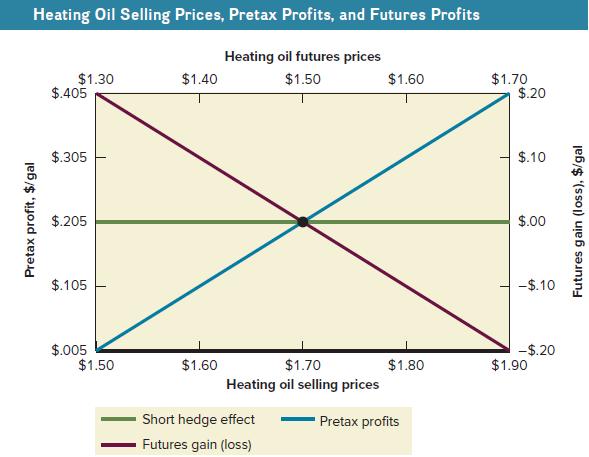

c. You have a short position in the underlying asset. How would you modify Figure 14.2 in this case?

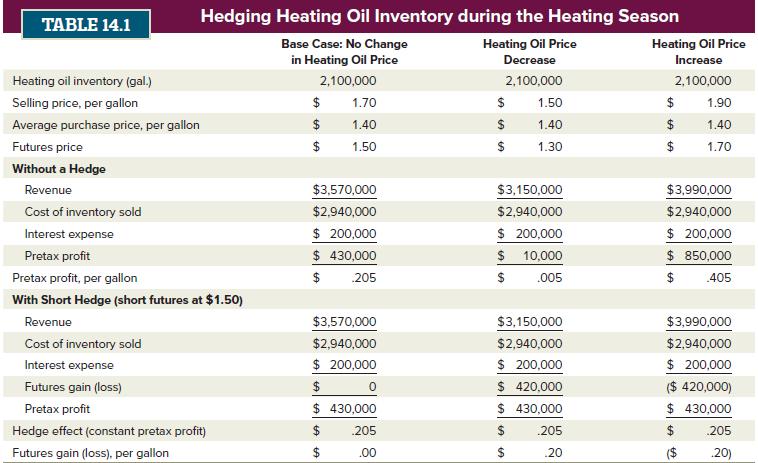

d. Suppose a firm has a long position in the underlying asset. What happens if this firm buys futures contracts instead of selling futures contracts? Create an example like the one shown in Table 14.1 to help explain the consequences.

Figure 14.2

Table 14.1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: