Dulari, a single member of the military, was stationed at Camp Pendleton, California. On July 1, 2021,

Question:

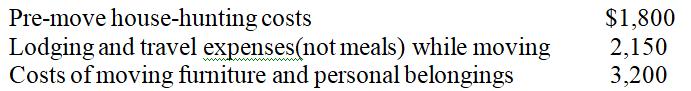

Dulari, a single member of the military, was stationed at Camp Pendleton, California. On July 1, 2021, her army company transferred her to Washington, DC, as a permanent duty station. Dulari worked full-time for the entire year. During 2021,she incurred and paid the following expenses related to the move:

She did not receive reimbursement for any of these expenses from the army; her AGI for the year was $35,500. What amount can Dulari deduct as moving expenses on her 2021 return?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Taxation 2022

ISBN: 9781264209408

15th

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander

Question Posted: