In 2021, Jeremy and Celeste who file a joint return, paid the following amounts for their daughter,

Question:

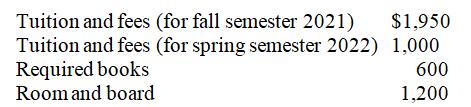

In 2021, Jeremy and Celeste who file a joint return, paid the following amounts for their daughter, Alyssa, to attend University of Colorado, during academic year 2021-2022. Alyssa was in her first year of college and attended full-time:

The spring semester at University of Colorado begins in January. In addition to the above, Alyssa’s uncle Devin sent $800 as payment for her tuition directly to the University. Jeremy and Celeste have modified AGI of $168,000. What is the amount of qualifying expenses for purposes of the American opportunity tax credit (AOTC) in tax year 2021? What is the amount of the AOTC that Jeremy and Celeste can claim based on their AGI?

Step by Step Answer:

Fundamentals Of Taxation 2022

ISBN: 9781264209408

15th

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander