BB Company is a manufacturer of guns. At the end of the current tax year, its inventory

Question:

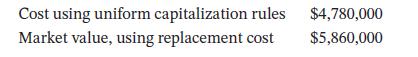

BB Company is a manufacturer of guns. At the end of the current tax year, its inventory had the following values:

BB uses the FIFO method to value its inventory. What value should be used for the inventory for tax purposes? How would your answer change, if at all, if BB uses the LIFO method?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Taxation For Individuals A Practical Approach 2024

ISBN: 9781119744191

1st Edition

Authors: Gregory A Carnes, Suzanne Youngberg

Question Posted: