Hazel died on February 22, Year 7 with a gross estate of ($5.6) million. In her will,

Question:

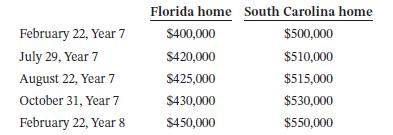

Hazel died on February 22, Year 7 with a gross estate of \($5.6\) million. In her will, she left her vacation home in Florida to her daughter and her vacation home in South Carolina to her son. Hazel had purchased the Florida home for \($250,000\) and the South Carolina home for \($365,000.\) Fair market values for the homes were as follows:

The executor of the estate properly elected the alternate valuation date. The Florida home was distributed on July 29 and the South Carolina home was distributed on October 31.

What are the daughter and son’s basis in the homes, respectively? What is the holding period for the daughter and son?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Taxation For Individuals A Practical Approach 2024

ISBN: 9781119744191

1st Edition

Authors: Gregory A Carnes, Suzanne Youngberg

Question Posted: