As discussed in Chapter 1, the International Accounting Standards Board (IASB) develops accounting standards for many international

Question:

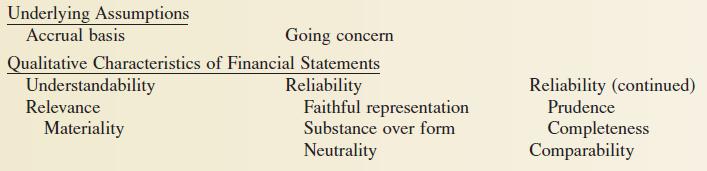

As discussed in Chapter 1, the International Accounting Standards Board (IASB) develops accounting standards for many international companies. The IASB also has developed a conceptual framework to help guide the setting of accounting standards. Following is an overview of the IASB framework.

Objective of Financial Statements

To provide information about the financial position, performance, and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions.

Constraints on Relevant and Reliable Information

Timeliness

Balance between benefit and cost

Balance between qualitative characteristics

True and Fair Presentation

Elements of Financial Statements

Asset: A resource controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise.

Liability: A present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow from the enterprise of resources embodying economic benefits.

Equity: The residual interest in the assets of the enterprise after deducting all its liabilities.

Income: Increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants.

Expenses: Decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants.

Instructions

Identify at least three similarities and at least three differences between the FASB and IASB conceptual frameworks as revealed in the above overview.

Step by Step Answer:

Intermediate Accounting principles and analysis

ISBN: 978-0471737933

2nd Edition

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso