Swarovski designs, manufactures, and sells jewellery/ crystal, genuine gemstones, created stones, and finished products such as accessories

Question:

Swarovski designs, manufactures, and sells jewellery/

crystal, genuine gemstones, created stones, and finished products such as accessories and lighting solutions. What started in 1895 as a small crystal manufacturing business in Wattens, Austria, has grown to be a global company, whose products are sold in 170 countries.

Product locations are in Austria, India, Thailand, Vietnam, Serbia, and the U.S.

Total revenues generated in 2017 were €2.6 billion.

The Swarovski Headquarters (HQ) is in Wattens, Austria.

The company is also involved in B2C activities, such as its figurines and home accessories range, beauty and fragrance offerings, and sunglasses and optical eyewear collections. The majority of its personal accessories sales takes place under the Swarovski brand in the jewellery category.

Swarovski, is predominantly present in the costume jewellery segment. Although Swarovski produces other personal accessories, such as quartz analogue watches and writing instruments, its business in personal accessories is still concentrated on costume jewellery. Swarovski is widely recognized for its craftsmanship and the patented technologies used to produce its signature crystals. It has now stretched its technological expertise to produce diamonds.

One of Swarovski’s key competitive advantages is the group’s constant innovation and development of patented cutting-edge technology. The bulk of Swarovski’s sales remain in the costume jewellery –

mainly crystals – but it is building up its reputation as a fine jeweller. First of all, it introduced a fine jewellery line in China in 2012, and more recently, the group launched a fine jewellery line in selected markets around the globe to celebrate the tenth anniversary of Swarovski Atelier. Finally, Swarovski has introduced Diama in the US, a line of fine jewels made of precious metals and the group’s own laboratory-made diamonds.

Having carved its niche in crystal, Swarovski’s business mostly sits in the affordable luxury range, and the brand is highly dependent upon the middle group, which is vulnerable to economic downturns.

Total world market for jewellery Jewellery sales account for nearly two-thirds of all personal accessories sales globally. The much higher average unit price is the main reason behind this prevalence. In 2017, global jewellery sales in general reached US$343 billion in constant terms, posting a CAGR of 4 per cent in the period 2012–2017, outgrowing all other personal accessories references.

Within jewellery, fine jewellery remains the most important value generator, claiming more than 80 per cent of all jewellery sales.

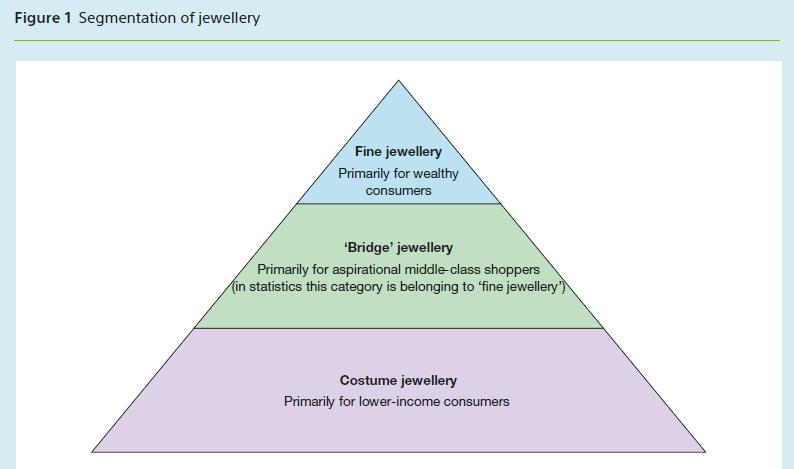

Jewellery market segmentation Costume jewellery is used to complement a particular costume outfit or garment as opposed to ‘fine

jewellery’, which may be regarded primarily as collectives or investments.

‘Bridge’ jewellery is costume jewellery that simulates fine jewellery, using silver, gold plating and semi-precious gemstones (see also Figure 1). The rise in middle-income groups globally is fueling demand for ‘bridge’ jewellery, which appeals to aspiring consumers in emerging countries who might not yet be able to afford fine jewellery. In the rest of the case this category is included in the ‘Fine jewellery’ for overview reasons.

Recent examples include Pandora’s Shine collection, making gold jewellery more affordable, yet equally desirable, offering 18ct gold-plated silver at a lower unit price.

For example, middle class Chinese consumers –

a key target group for Swarovski – are no longer purchasing fine jewellery for special occasions like weddings but are looking to experiment with trends more often.

‘Bridge’ jewellery also provides a platform for consumers looking for an amalgamation of fine and costume jewellery, and has struck a chord among consumers in Europe and the US since the recession, providing them with more purchasing power and lower prices than fine jewellery.

Swarovski launched a fine jewellery line in China in 2012. More recently, the group launched a line of Swarovski Atelier fine jewellery in key markets.

To prevent cannibalizing its costume business, the group needs to keep its fine jewellery pieces very exclusive to appeal to high-end jewel buyers, and turn them into aspirational products for most of its existing customer base for costume jewellery.....

Questions

One of the owners of the family company has asked you to give inputs to the future global marketing strategy by answering/solving the following questions/

tasks:

1. Explain the customer value proposition (CVP) that is connected to the Swarovski versus the Pandora brand.

2. How will you make an international market selection (IMS) in order to come up with a country ranking of the five key jewellery markets?

3. What is your final recommendation for the ranking of the five key markets?

4. Suggest a global marketing programme for Swarovski, including a suggestion for the priority of the 4Ps: product, price, place and promotion.

5. Make a recommendation for Swarovski’s social media marketing plan.

Step by Step Answer: