Employer sponsored insurance. Consider a RothschildStiglitz model of adverse selection in which there are two types of

Question:

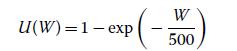

Employer sponsored insurance. Consider a Rothschild–Stiglitz model of adverse selection in which there are two types of people (robust and frail) who work for a single employer, BHT Inc. Both types of people are risk-averse in income and have utility function of wealth

During any given year, the probability of becoming ill for the robust and frail is given by pfrail =0.2, and probust =0.1. If a person falls ill, the cost of treatment (that is, damages) is $200. BHT Inc. is deciding whether to offer their workers insurance. The firm is assumed to be risk-neutral.

Each worker pays BHT a premium at the beginning of the year, and if the worker falls ill, the insurer will pay the worker some amount of coverage. When they decide whether to buy insurance, workers know if they are robust or frail (though they do not know if they will fall ill during the year), but neither BHT Inc. nor BHT Insurance Co.

can observe any worker’s health status. Workers will, of course, misrepresent their type if it is in their interest to do so.

The firm decides what insurance plan (coverage and premium) to offer workers, and workers decide whether to purchase the plan or not by maximizing their expected utility. All workers have $1, in initial wealth.

a. BHT first proposes a contract for robust workers. The contract offers full coverage of the damages (that is, an individual receives $ if he falls ill). What is the maximum premium BHT could price the contract, so that it remains attractive for robust people? Would selling this contract (at the maximum premium) to robust people be a good decision for BHT? You can ignore frail workers for this part of the question.

b. BHT decides to price the Total Coverage for Robust People contract at a premium of $23. Would frail people want to buy this contract? If a frail person bought this contract by pretending to be robust, on average, would BHT make or lose money?

c. To avoid this adverse selection, BHT Inc. thinks of designing a total coverage contract for frail workers. What is the maximum premium frail workers would be willing to pay for this contract?

d. If only frail workers buy the contract, what is the minimum premium BHT Inc.

could charge for a full insurance contract to just break even? Would frail people want to buy this contract? Would robust people want to buy it?

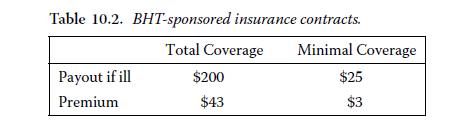

e. BHT decides to launch two contracts: Total Coverage and Minimal Coverage. The characteristics of both contracts are given in Table 10.2. Workers choose between total coverage, minimal coverage, and no coverage.

(i) Do frail workers prefer total coverage, minimal coverage, or no coverage?

(ii) Do robust workers prefer total coverage, minimal coverage, or no coverage?

(iii) Suppose BHT Inc. has 100 workers, of which 75 are frail and 25 are robust.

What is the firm’s expected profits from offering these two contracts?

f. In order for insurance to be sold, the insurer must be more risk-neutral than the customers. In this case, we assumed that the firm is risk-neutral, while the workers are risk-averse. Could the insurance market still function if we assumed that the firm also had utility function![]()

Step by Step Answer: