2017 Jun. 10 Steven Hodgson and Sarah Asham have agreed to pool their assets and form a...

Question:

2017

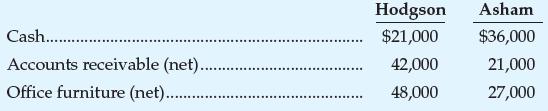

Jun. 10 Steven Hodgson and Sarah Asham have agreed to pool their assets and form a partnership to be called H&A Distributors. They agree to share all profits equally and make the following initial investments:

Dec. 31 The partnership’s reported net income was $228,000 for the year.

2018

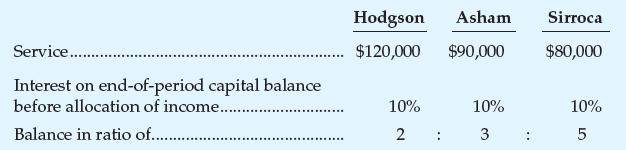

Jan. 1 Hodgson and Asham agree to accept Myra Sirroca into the partnership with a $210,000 investment for 40 percent of the business. The partnership agreement is amended to provide for the following sharing of profits and losses:

Dec. 31 The partnership’s reported net income is $570,000.

2019

Oct. 10 Hodgson withdrew $90,000 cash from the partnership and Asham withdrew $60,000 (Sirroca did not make any withdrawals).

Dec. 31 The partnership’s reported net income is $225,000.

2020

Jan. 2 After a disagreement as to the direction in which the partnership should be moving, Sirroca decided to withdraw from the partnership. The three partners agreed that Sirroca could take cash of $510,000 in exchange for her equity in the partnership.

Required

1. Journalize all of the transactions for the partnership.

2. Prepare the partners’ equity section of the balance sheet as of January 2, 2020.

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood