Angel Landscaping Services started the year 2023 with an Accounts Receivable balance of $40,500 and an Allowance

Question:

Angel Landscaping Services started the year 2023 with an Accounts Receivable balance of $40,500 and an Allowance for Doubtful Accounts balance of $4,310. During the year, $4,290 of accounts receivable were identified as uncollectible. Sales revenue for 2023 was $429,000, including credit sales of $422,400. Cash collections on account were $415,600 during the year.

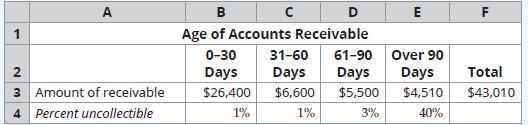

The aging of accounts receivable yields these data:

You are the accountant preparing the December 31, 2023, year-end entries.

Required

1. Journalize Angel’s

(a) Credit sales,

(b) Cash collections on account,

(c) Write-off of the accounts receivable identified as uncollectible, and

(d) Bad debt expense based on 0.5 percent of credit sales.

2. Prepare a T-account for the Accounts Receivable and Allowance for Doubtful Accounts accounts.

3. Calculate the balance in Allowance for Doubtful Accounts based on the aging-ofaccounts- receivable method.

4. Make any adjustment required to the Allowance for Doubtful Accounts based on your calculation in Requirement 3.

5. Show how Angel Landscaping Services should report Accounts Receivable on the balance sheet.

Step by Step Answer:

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura