Canmore Services Inc. started business on March 1, 2023. The company produces monthly financial statements and had

Question:

Canmore Services Inc. started business on March 1, 2023. The company produces monthly financial statements and had total sales of $600,000 (of which $570,000 were on account) during the first 4 months.

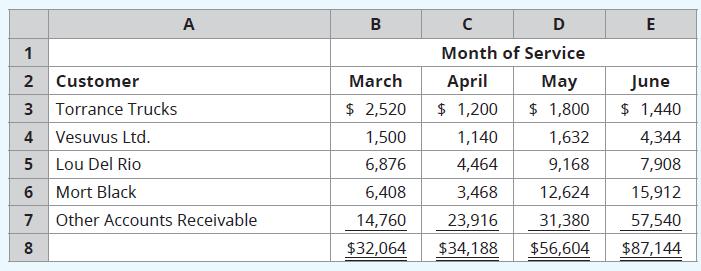

On June 30, the Accounts Receivable account had a balance of $210,000 (no accounts have been written off to date), which was made up of the following accounts aged according to the date the services were provided:

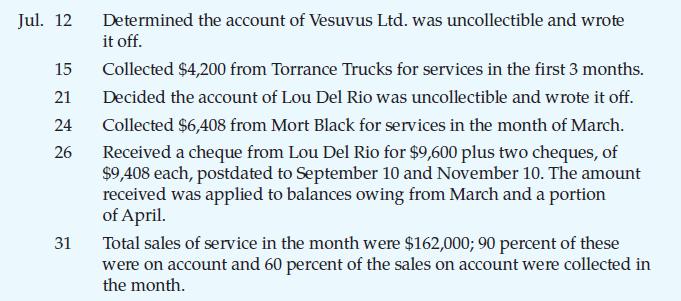

The following accounts receivable transactions took place in July 2023:

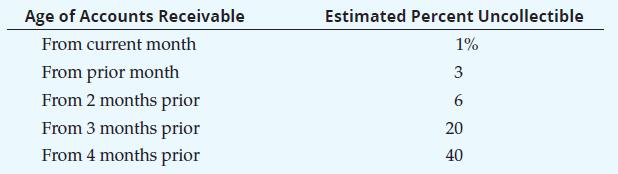

Required1. Canmore Services Inc. has heard that other companies in the industry use the allowance method of accounting for uncollectibles, with many of these estimating the uncollectibles through an aging of accounts receivable.

a. Journalize the adjustments that would have to be made on June 30 (for the months of March through June), assuming the following estimates of uncollectibles:

(Round your total estimate to the nearest whole dollar.)

b. Journalize the transactions of July 2023.

c. Journalize the month-end adjustment, using the information from the table that appears in Requirement 1a.

2. For the method of accounting for the uncollectibles used above, show:

a. The balance sheet presentation of the accounts receivable.

b. The overall effect of the uncollectibles on the income statement for the months of June and July 2023.

Step by Step Answer:

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura