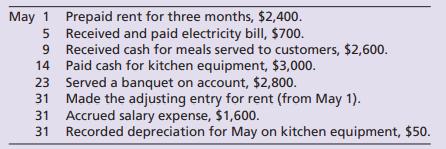

Chefs Catering completed the following selected transactions during May 2024: Requirements 1. Show whether each transaction would

Question:

Chef’s Catering completed the following selected transactions during May 2024:

Requirements

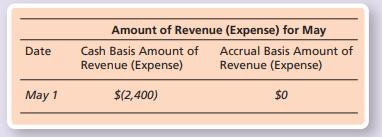

1. Show whether each transaction would be handled as a revenue or an expense using both the cash basis and accrual basis accounting systems by completing the following table. (Expenses should be shown in parentheses.) Also, indicate the dollar amount of the revenue or expense. The May 1 transaction has been completed as an example.

2. After completing the table, calculate the amount of net income or net loss for Chef ’s Catering under the accrual basis and cash basis accounting systems for May.

3. Considering your results from Requirement 2, which method gives the best picture of the true earnings of Chef ’s Catering? Why?

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison