Crystal Clear Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products.

Question:

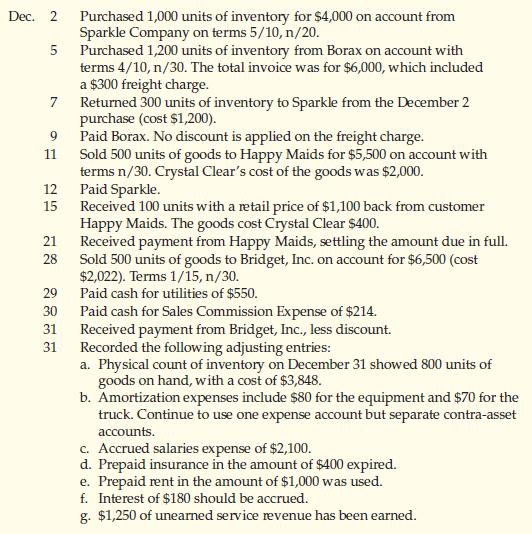

Crystal Clear Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Crystal Clear uses the perpetual inventory system. During December 2022, Crystal Clear completed the following transactions:

Required

1. If you did not complete Chapter 4, open the following T-accounts in the ledger: Cash, $51,650; Accounts Receivable, $4,000; Inventory, $0; Cleaning Supplies, $50; Prepaid Rent, $3,000; Prepaid Insurance, $4,400; Equipment, $5,400; Accumulated Amortization—Equipment, $80; Truck, $3,000; Accumulated Amortization—Truck, $70; Accounts Payable, $1,245; Salaries Payable, $0; Interest Payable, $59; Unearned Revenue, $14,375; Notes Payable, $36,000; A. Hideaway, Capital, $19,671; A. Hideaway, Withdrawals, $0; Service Revenue, $0; Sales Revenue, $0; Sales Discounts, $0; Sales Returns and Allowances, $0; Cost of Goods Sold, $0; Salaries Expense, $0; Sales Commission Expense, $0; Utilities Expense, $0; Amortization Expense, $0; Rent Expense, $0; Insurance Expense, $0; Interest Expense, $0. If you did complete the work on this problem in Chapter 4, then open the following new T-accounts with zero balances: Inventory, Sales Revenue, Sales Discounts, Sales Returns and Allowances, Cost of Goods Sold, and Sales Commission Expense.

2. Journalize and post the December transactions. Omit explanations. Compute each account balance and denote the balance as Balance. Identify each accounts payable and accounts receivable with the vendor or customer name in the journal entries. (For example, Accounts Payable—Sparkle Company.)

3. Journalize and post the adjusting entries. Omit explanations. Denote each adjusting amount as Adj. Compute each account balance and denote the balance as Balance. After posting all adjusting entries, prove the equality of debits and credits in the ledger by preparing an adjusted trial balance.

4. Prepare the multi-step income statement and statement of owner’s equity for the month ended December 31, 2022. Also prepare a classified balance sheet at December 31, 2022. Assume the note payable is long-term. List expenses in the order they are shown in the adjusted trial balance.

5. Compute the gross profit percentage for December for the company.

Step by Step Answer:

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura