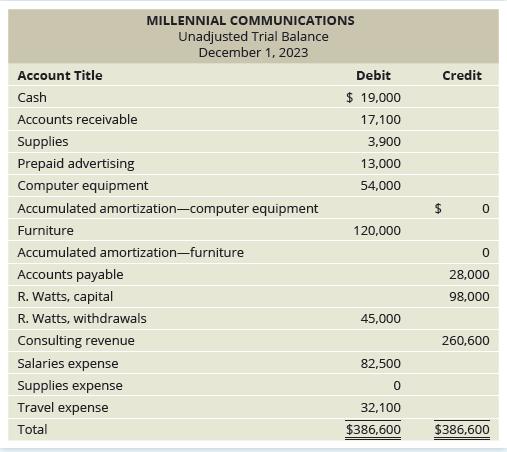

Millennial Communications provides management consulting services. The business had the following account balances: The following transactions occurred

Question:

Millennial Communications provides management consulting services. The business had the following account balances:

The following transactions occurred during December:

a. On December 1, paid cash for an Internet advertising consultant for 4 months of work in advance. The contract was for $3,200 per month. Work will begin on January 1, 2024.

b. On December 10, supplies in the amount of $2,975 were purchased on account.

c. On December 18, the company received a cash advance of $4,000 for work to be performed starting January 1.

d. On December 30, the company provided consulting services to a customer for $12,500; payment will be received in 30 days.

The following adjustments information was available on December 31, 2023:

e. A physical count shows $5,100 of supplies remaining on hand on December 31.

f. The computer equipment has an expected useful life of 4 years with no residual value after 4 years. The computers were purchased on January 2 of this year, and the straight-line method of amortization is used.

g. The furniture, purchased on January 2, is expected to be used for 8 years with no expected value after 8 years. The straight-line method of amortization is used.

h. On October 1, Millennial Consulting hired an advertising firm to prepare a marketing plan and agreed to pay the firm $2,200 per month. Millennial Consulting paid for 5 months’ work in advance and has made no adjusting entries for this during 2023. Record the portion of the prepayment that has been used to date.

i. The company’s office manager, who earns $400 per day, worked the last 5 days of the year and will be paid on January 5, 2024.

Required

1. Journalize the entries. Add new accounts if necessary.

2. Prepare an adjusted trial balance on December 31, 2023.

3. Prepare an income statement for the year ended December 31, 2023. List expenses in alphabetical order.

4. Prepare a statement of owner’s equity for the year ended December 31, 2023. Assume there have been no changes to the capital account since January 1.

5. Prepare a balance sheet at December 31, 2023.

Step by Step Answer:

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura