Caldwell Toys produces toys mainly for the domestic market. The company uses a job-costing system under which

Question:

Caldwell Toys produces toys mainly for the domestic market. The company uses a job-costing system under which materials and labors used in the manufacturing process are directly allocated to different jobs. Whereas costs incurred in the manufacturing support department are indirect in nature and allocated to different jobs on the basis of direct labor-hours. Caldwell budgets 2017 manufacturing-support costs to be \($5,100,000\) and 2017 direct labor-hours to be 150,000.

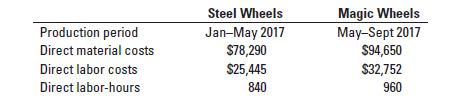

At the end of 2017, Caldwell collects the cost-related data of different jobs that were started and completed in 2017 for comparison. They are as follows:

Direct materials and direct labor are paid for on a contractual basis. The costs of each are known when direct materials are used or when direct labor-hours are worked. The 2017 actual manufacturing-support costs were \($5,355,000\) and the actual direct labor-hours were 153,000.

1. Compute the

(a) budgeted indirect-cost rate and

(b) actual indirect-cost rate. Why do they differ?

2. What are the job costs of the Steel Wheels and the Magic Wheels using

(a) normal costing and

(b) actual costing?

3. Why might Caldwell Toys prefer normal costing over actual costing?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292211541

16th Global Edition

Authors: Srikant Datar, Madhav Rajan