Legion Bank (LB) is examining the profitability of its Star Account, a combined savings and checking account.

Question:

Legion Bank (LB) is examining the profitability of its Star Account, a combined savings and checking account. Depositors receive a 6% annual interest rate on their average deposit. LB earns an interest rate spread of 3% (the difference between the rate at which it lends money and the rate it pays depositors) by lending money for home-loan purposes at 9%. Thus, LB would gain $150 on the interest spread if a depositor had an average Star Account balance of $5,000 in 2020 ($5,000 * 3% = $150).

The Star Account allows depositors unlimited use of services such as deposits, withdrawals, checking accounts, and foreign currency drafts. Depositors with Star Account balances of $1,000 or more receive unlimited free use of services. Depositors with minimum balances of less than $1,000 pay a $25-a-month service fee for their Star Account.

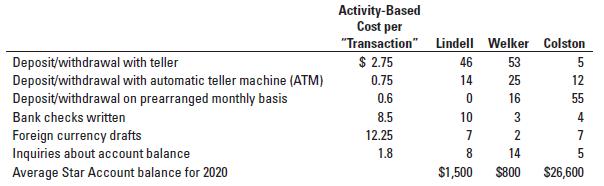

LB recently conducted an activity-based costing study of its services. It assessed the following costs for six individual services. The use of these services in 2020 by three customers is as follows:

Required

Assume Lindell and Colston always maintain a balance above $1,000, whereas Welker always has a balance below $1,000.

1. Compute the 2020 profitability of the Lindell, Welker, and Colston Star Accounts at LB.

2. Why might LB worry about the profitability of individual customers if the Star Account product offering is profitable as a whole?

3. What changes would you recommend for LB’s Star Account?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan