Refresh Resorts, Inc., operates health spas in Key West, Florida; Phoenix, Arizona; and Carmel, California. The Key

Question:

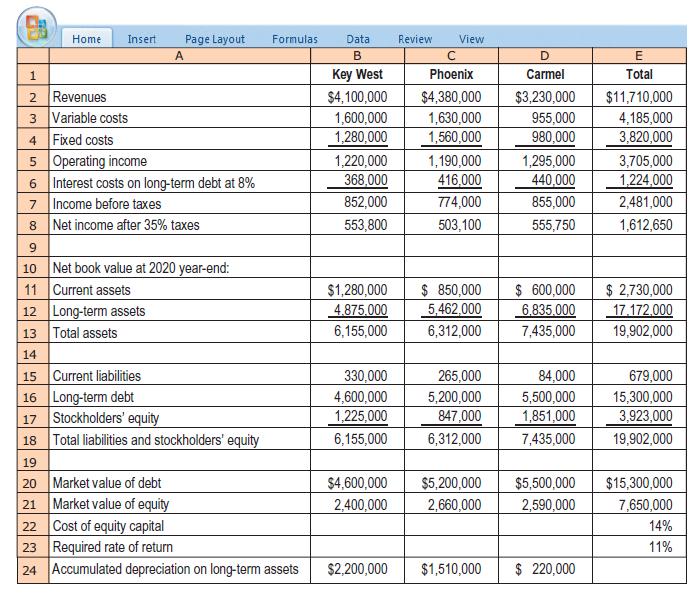

Refresh Resorts, Inc., operates health spas in Key West, Florida; Phoenix, Arizona; and Carmel, California. The Key West spa was the company’s first and opened in 1994. The Phoenix spa opened in 2007, and the Carmel spa opened in 2016. Refresh Resorts has previously evaluated divisions based on RI, but the company is considering changing to an EVA approach. All spas are assumed to face similar risks. Data for 2020 are shown below:

Required

1. Calculate RI for each of the spas based on operating income and using total assets as the measure of investment. Suppose that the Key West spa is considering adding a new group of saunas from Finland that will cost $225,000. The saunas are expected to bring in operating income of $22,000. What effect would this project have on the RI of the Key West spa? Based on RI, would the Key West manager accept or reject this project? Without resorting to calculations, would the other managers accept or reject the project? Why?

2. Why might Refresh Resorts want to use EVA instead of RI for evaluating the performance of the three spas?

3. Refer back to the original data. Calculate the WACC for Refresh Resorts.

4. Refer back to the original data. Calculate EVA for each of the spas, using net book value of long-term assets. Calculate EVA again, this time using gross book value of long-term assets. Comment on the differences between the two methods.

5. How does the selection of asset measurement method affect goal congruence?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan