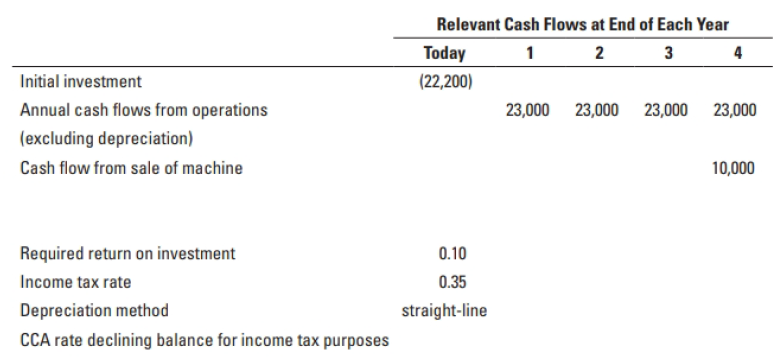

Crazy Mama has just heard about payback period and IRR. Assume the CCA rate is 20%, and

Question:

Crazy Mama has just heard about payback period and IRR. Assume the CCA rate is 20%, and refer to the following information to answer the questions below.

1. Calculate the payback period.

2. Compare the payback method with the NPV method. Describe a situation where the payback method would be more appropriate to evaluate a capital budgeting decision.

Capital BudgetingCapital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 978-0134453736

8th Canadian Edition

Authors: Srikant M. Datar, Madhav V. Rajan, Louis Beaubien

Question Posted: