Archer Corporation had the following payroll data for April: The combined FICA tax rate (for both employee

Question:

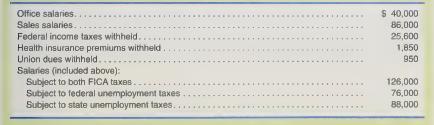

Archer Corporation had the following payroll data for April:

The combined FICA tax rate (for both employee withholding and employer) is 7.65 percent (6.2 percent plus 1.45 percent), the federal unemployment compensation tax rate is 0.6 percent. and the state unemployment compensation tax rate is 5.4 percent. The amounts subject to these taxes are given above. Required Prepare journal entries to record the following on April 30:

a. Accrual of the payroll.

b. Payment of the net payroll.

c. Accrual of the employer's payroll taxes.

d. Payment of all liabilities related to the payroll. (Assume that all liabilities are paid at the same time.)

Step by Step Answer:

Financial & Managerial Accounting For Undergraduates

ISBN: 9781618533104

2nd Edition

Authors: Jason Wallace, James Nelson, Karen Christensen, Theodore Hobson, Scott L. Matthews