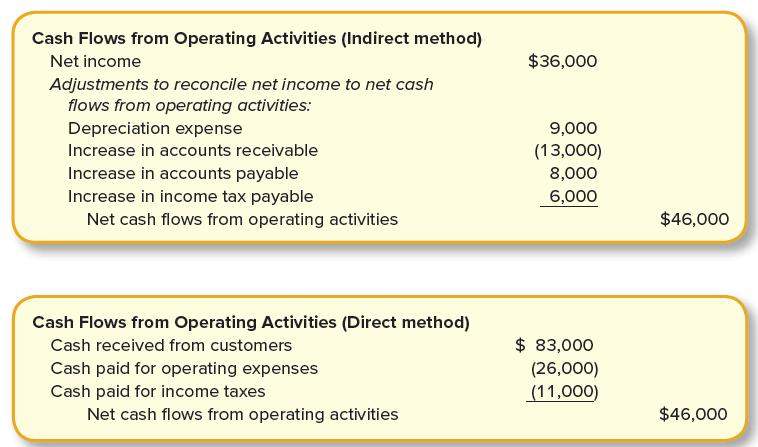

Cash flows from operating activities for both the indirect and direct methods are presented for Electronic Transformations.

Question:

Cash flows from operating activities for both the indirect and direct methods are presented for Electronic Transformations.

Required:

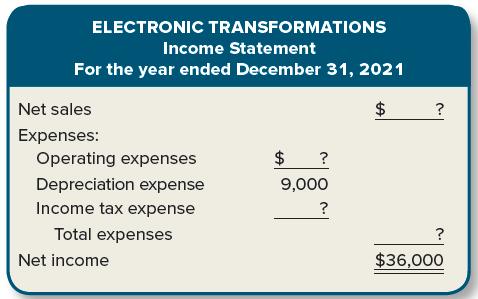

Complete the following income statement for Electronic Transformations. Assume all accounts payable are to suppliers.

Net sales

± Change in accounts receivable .................... _______

= Cash received from customers ...................... _______

Operating expenses

± Change in accounts payable ......................... _______

= Cash paid for operating expenses .............. _______

Income tax expense

± Change in income tax payable .................... _______

= Cash paid for income taxes .......................... _______

Step by Step Answer:

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann