1. The following additional information is available for the family of Albert and Allison Gaytor. In 2018,...

Question:

1. The following additional information is available for the family of Albert and Allison Gaytor.

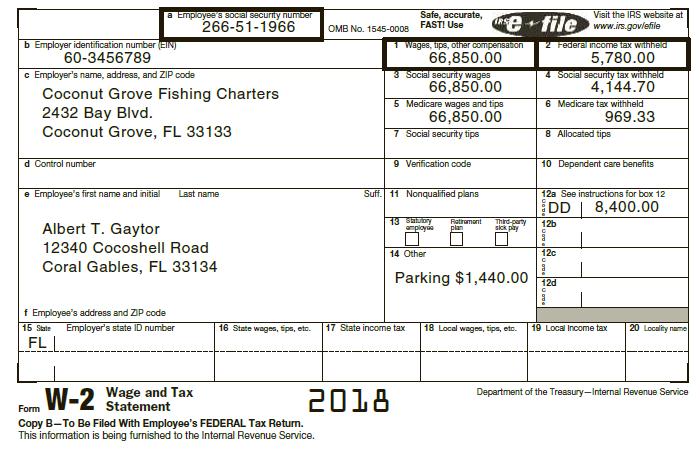

In 2018, Albert received a Form W-2 from his employer, Coconut Grove Fishing Charters, Inc. (hint: slightly modified from Chapter 1):

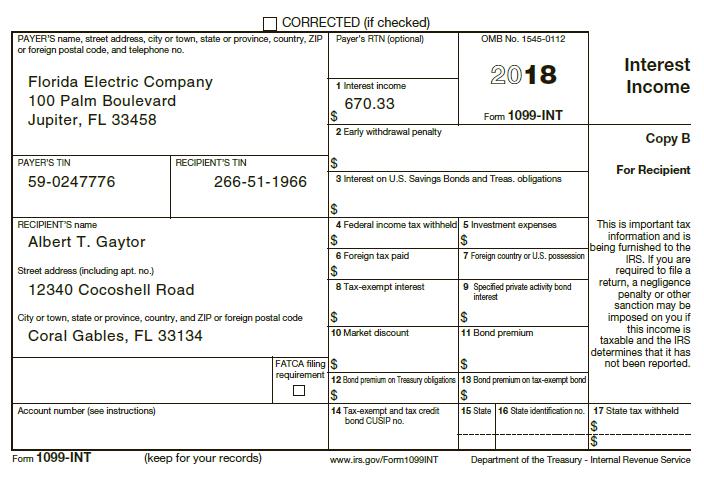

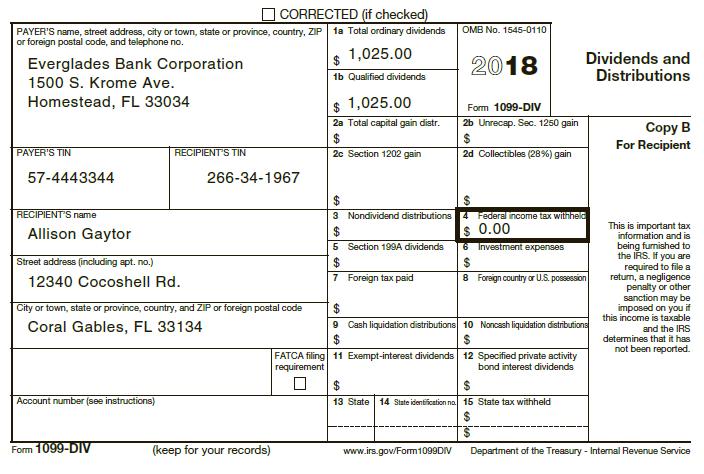

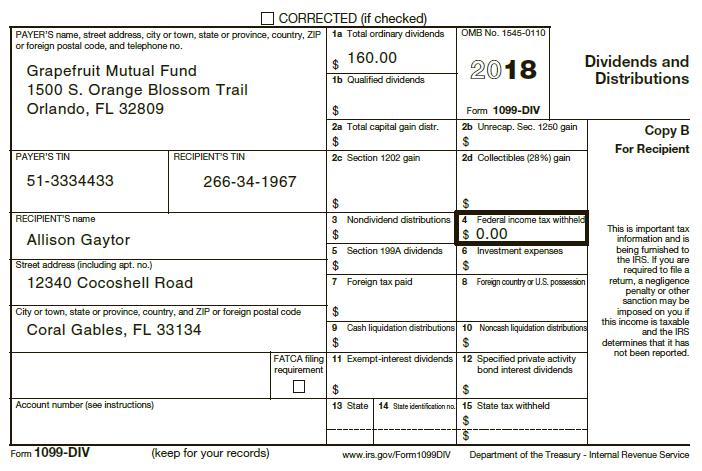

In addition to the interest from Chapter 1, Albert and Allison also received three Forms 1099:

The Gaytors also received interest of $745 from bonds issued by the Miami-Dade County Airport Authority (Form 1099 not shown).

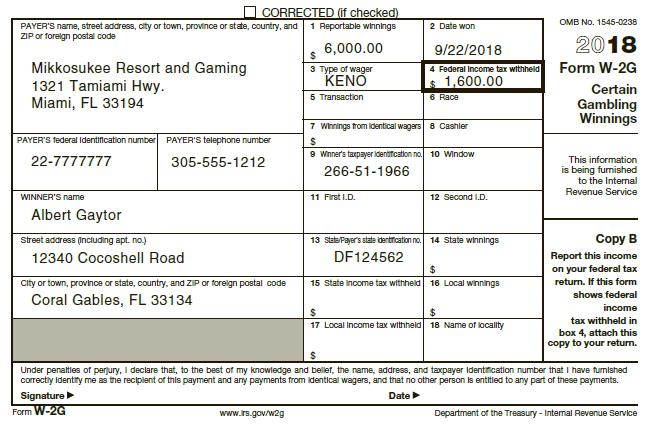

Albert went to the casino on his birthday and won big, as reflected on the following Form W-2G:

Albert had no other gambling income or losses for the year.

In February, Allison received $50,000 in life insurance proceeds from the death of her friend, Sharon.

In July, Albert’s uncle Ivan died and left him real estate (undeveloped land) worth $72,000.

Five years ago, Albert and Allison divorced. Albert married Iris, but the marriage did not work out and they divorced a year later. Under the 2014 divorce decree, Albert pays Iris $11,500 per year in alimony. All payments were on time in 2018 and Iris’ Social Security number is 667-34-9224. Three years ago, Albert and Allison were remarried.

Coconut Fishing Charters, Inc. pays Albert’s captain’s license fees and membership dues to the Charter Fisherman’s Association. During 2018, Coconut Fishing paid $1,300 for such dues and fees for Albert.

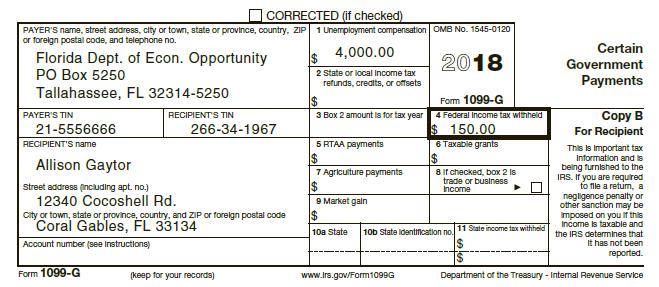

Allison was laid off from her job on January 2, 2018. She received a Form 1099-G for unemployment benefits:

Albert and his family are covered by an employee-sponsored health plan at his work.

Coconut Fishing pays $700 per month in premiums for Albert and his family. During the year, Allison was in the hospital for appendix surgery. The bill for the surgery was $10,100 of which the health insurance reimbursed Albert the full $10,100.

Coconut Fishing also pays for Albert’s parking at the marina. The monthly cost is $120.

Required:

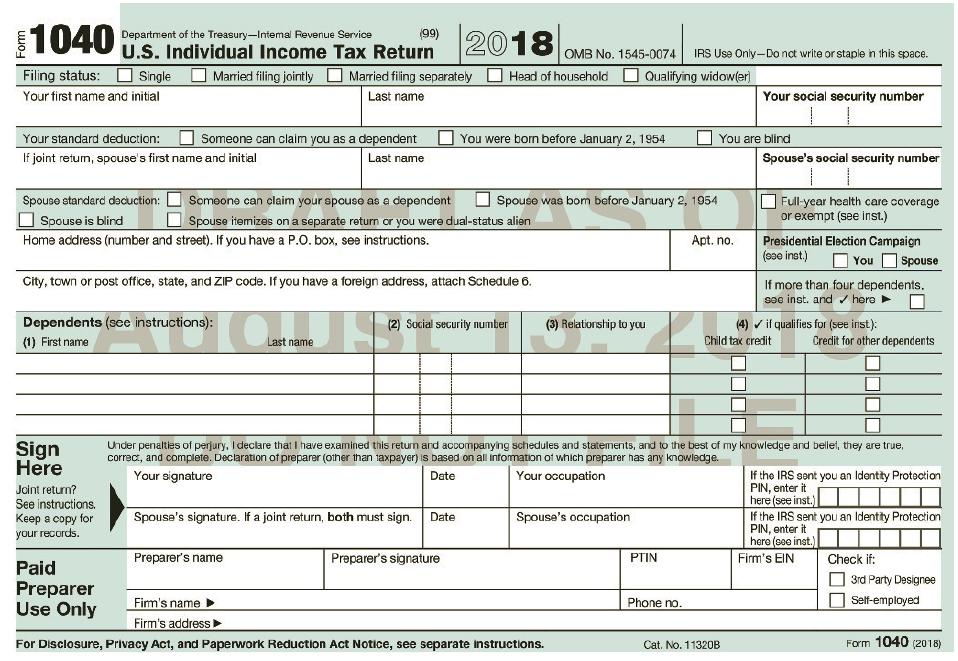

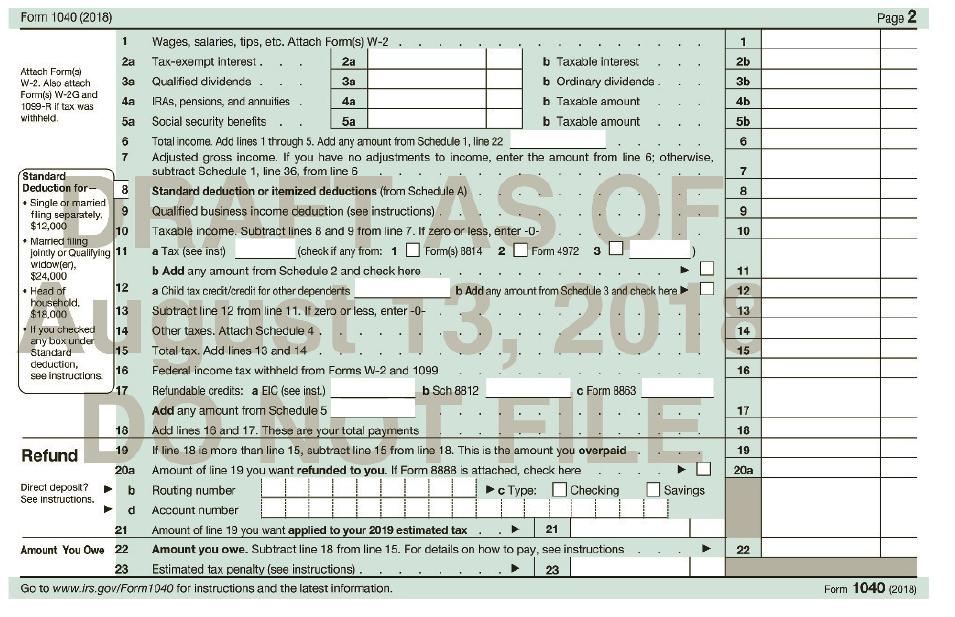

Combine this new information about the Gaytor family with the information from Chapter 1 and complete a revised 2018 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded with more tax information in later chapters.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill