Question:

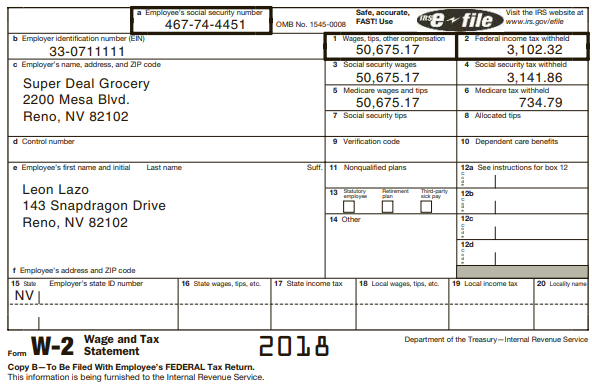

A. Leslie and Leon Lazo are married and file a joint return for 2018. Leslie’s Social Security number is 466-47-3311 and Leon’s is 467-74-4451. They live at 143 Snapdragon Drive, Reno, NV 82102. For 2018, Leslie did not work, and Leon’s W-2 from his butcher’s job showed the following:

Leslie and Leon have a 20-year-old son named Lyle (Social Security number 552-52-5552), who is a dependent that lives with them, is not a full-time student, and generates $5,200 of gross income for himself. Required: Complete Form 1040 for Leslie and Leon for the 2018 tax year.

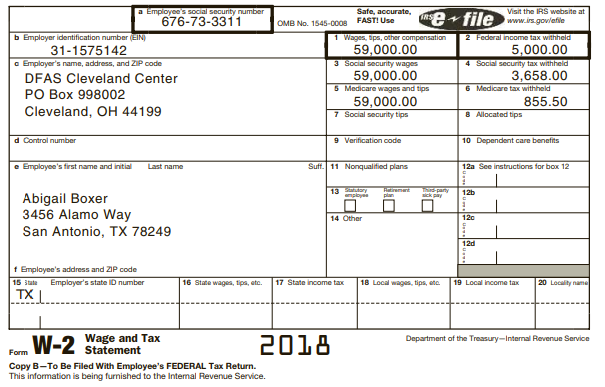

B. Abigail (Abby) Boxer is a single mother working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 Alamo Way, San Antonio, TX 78249. Helen, Abby’s 18-year-old daughter (Social Security number 676-73-3312), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby’s Form W-2 from the U.S. Department of Defense shows the following:

Abby also has taxable interest from Arroyo Seco Bank of $300 and tax-exempt interest from bonds issued by the city of San Antonio of $127. Required: Complete Form 1040 for Abigail for the 2018 tax year.

Transcribed Image Text:

a Employee's social security number Visit the RS website at www.irs.gov/efile Safe, accurate, FAST! Use efile IRS 467-74-4451 OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 50,675.17 3,102.32 33-0711111 a Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheid 3,141.86 6 Medicare tax withheld 734.79 50,675.17 5 Medicare wages and tips 50,675.17 7 Social security tips Super Deal Grocery 2200 Mesa Blvd. Reno, NV 82102 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's frst name and initial Suff. 11 Nonqualified plans Last name 12a See instructions for box 12 Leon Lazo 13 ay employ Tha party Aatrenent 12b 143 Snapdragon Drive Reno, NV 82102 14 Other 120 12d f Employee's address and ZIP code 17 State income tax 15 State Employer's state D number 16 State wages, Sps, atc. 18 Local wages, tips, etc. 19 Local income tax 20 Locality name NVI 2018 Department of the Treasury-Internal Revenue Service Fom W-2 Wage and Tax Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. io a Employee's social security number 676-73-3311 Safe, acourate, FAST! Use efile Visit the IRS website at www.irs.gov/efile OMB No. 1545-0008 b Employer identification number (EIN) 31-1575142 a Employer's name, address, and ZIP code DFAS Cleveland Center 1 Wages, sps, other compensation 59,000.00 3 Social security wages 59,000.00 5 Medicare wages and tips 2 Federal income tax withheld 5,000.00 4 Social security tax withheld 3,658.00 6 Medicare tax withheld PO Box 998002 Cleveland, OH 44199 59,000.00 7 Social security tips 855.50 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Suff. 11 Nonqualitied plans Last name 12a See instructions for box 12 mployee Ratiremant plan Tad-party ick pay 12b Abigail Boxer 3456 Alamo Way San Antonio, TX 78249 14 Other 120 12d 1 Employee's address and ZIP code 15 sute Employer's state ID number TXL 16 State wages, tips, eta. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Wage and Tax Statement Department of the Treasury-Internal Revenue Service W-2 2018 Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service.