Floyd Corporation was formed and began operations on January 1, 2020. The corporation is located at 210

Question:

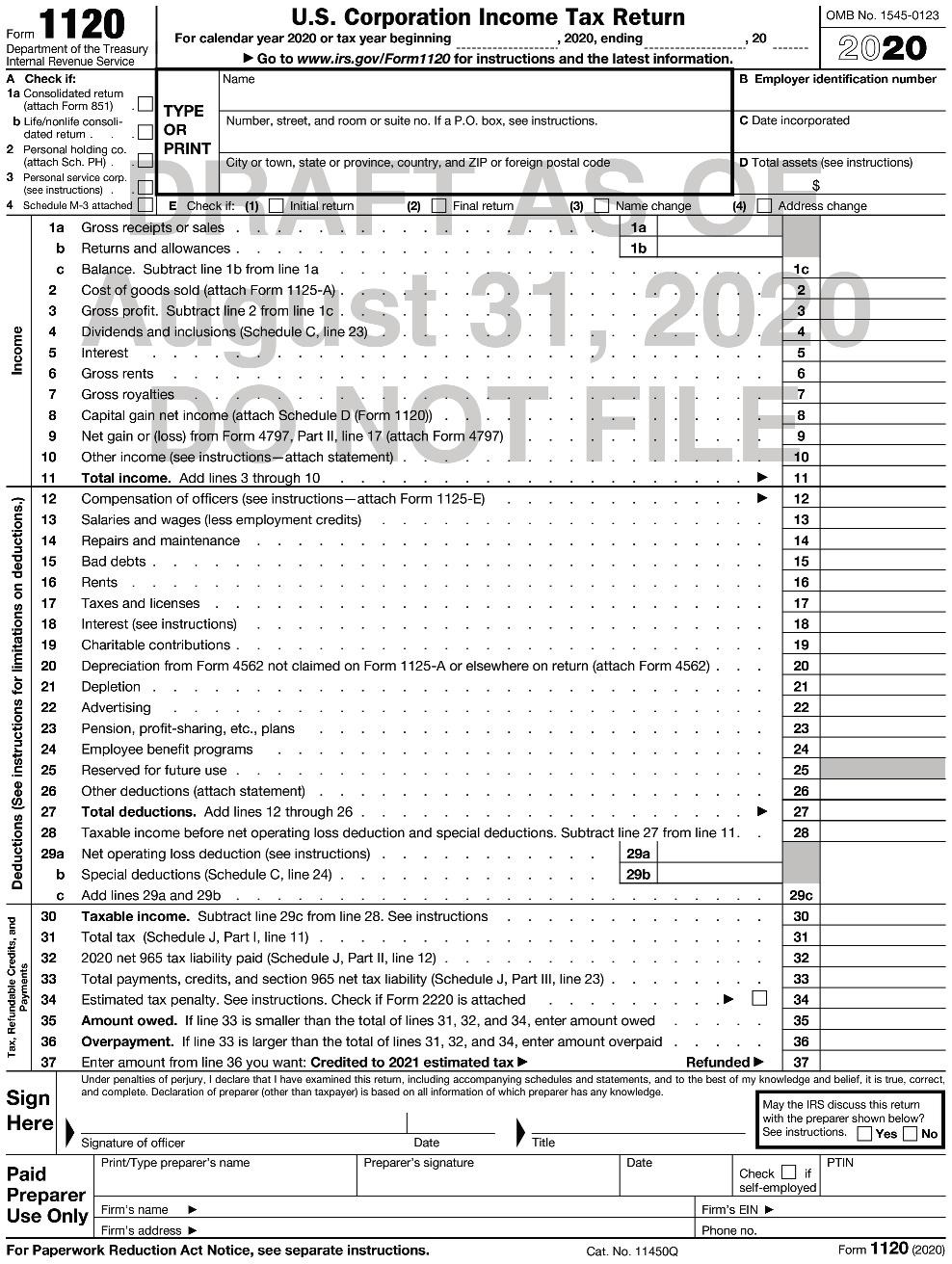

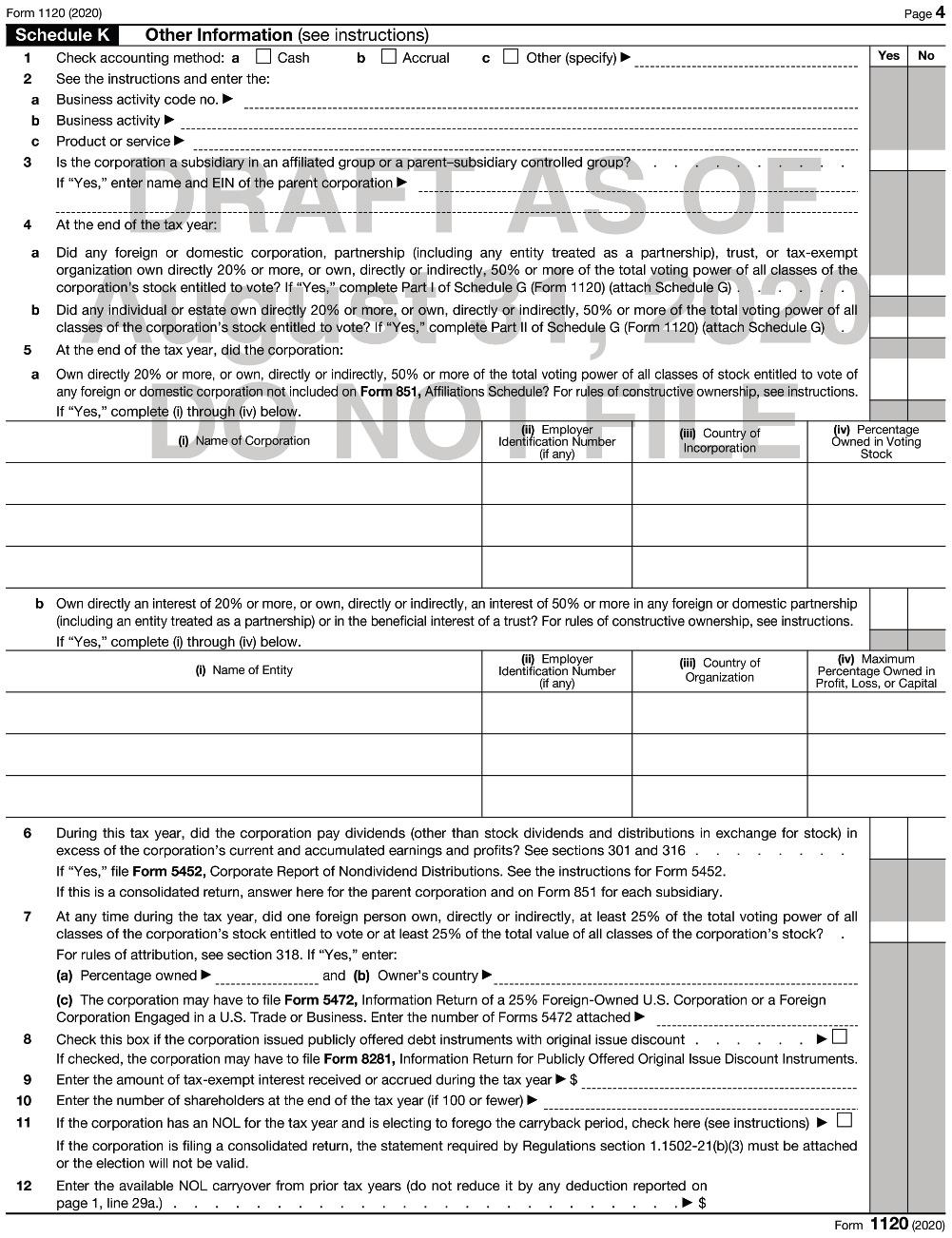

Floyd Corporation was formed and began operations on January 1, 2020. The corporation is located at 210 N. Main St., Pearisburg, VA 24134 and the EIN is 91-1111111.

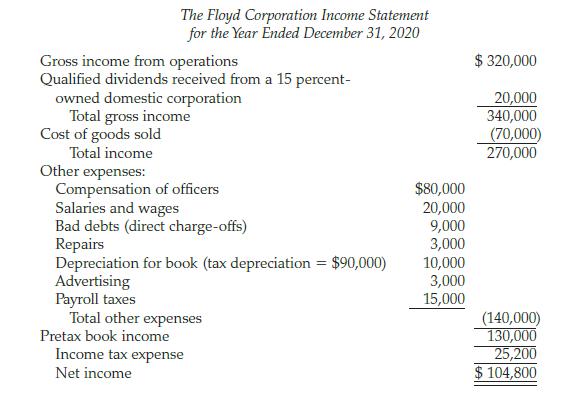

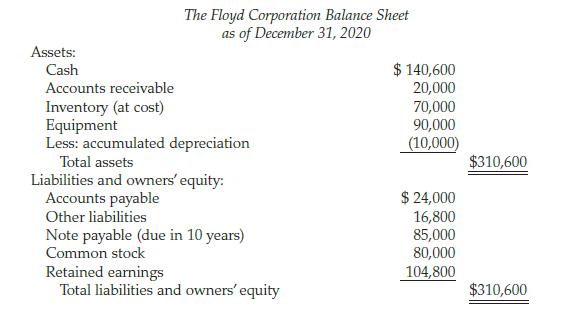

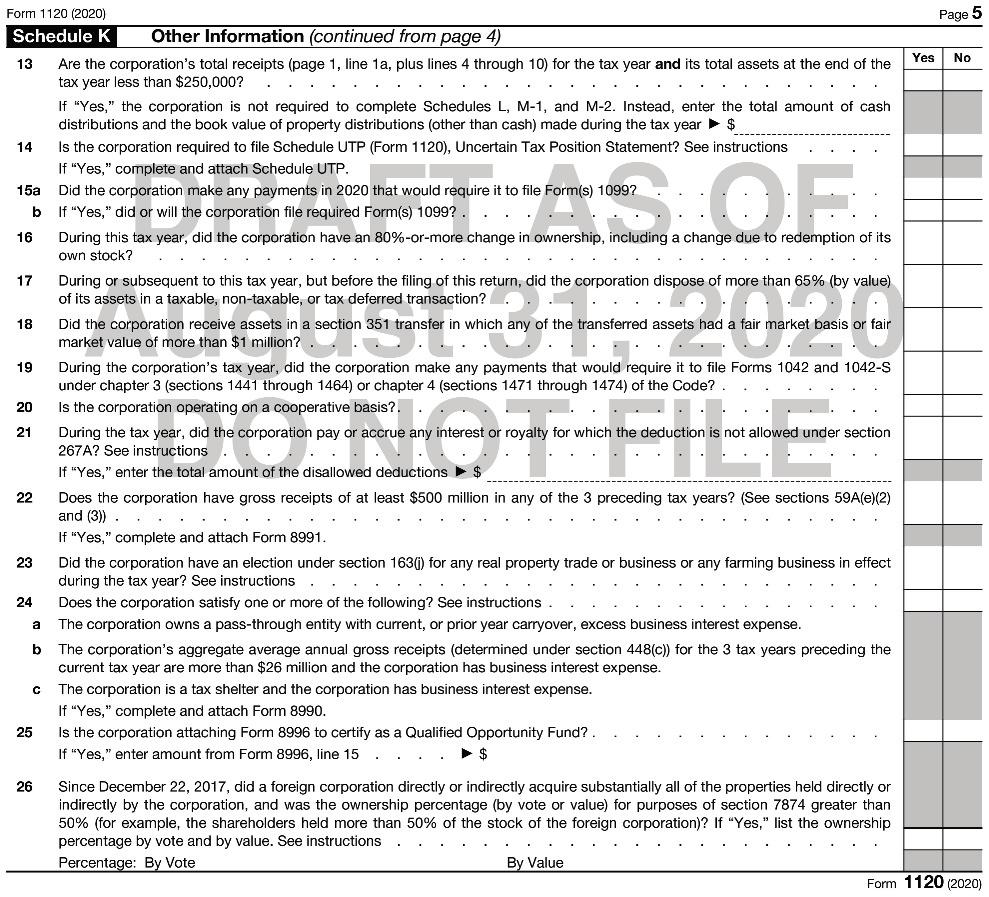

The corporation’s income statement for the year and the balance sheet at year-end are presented below.

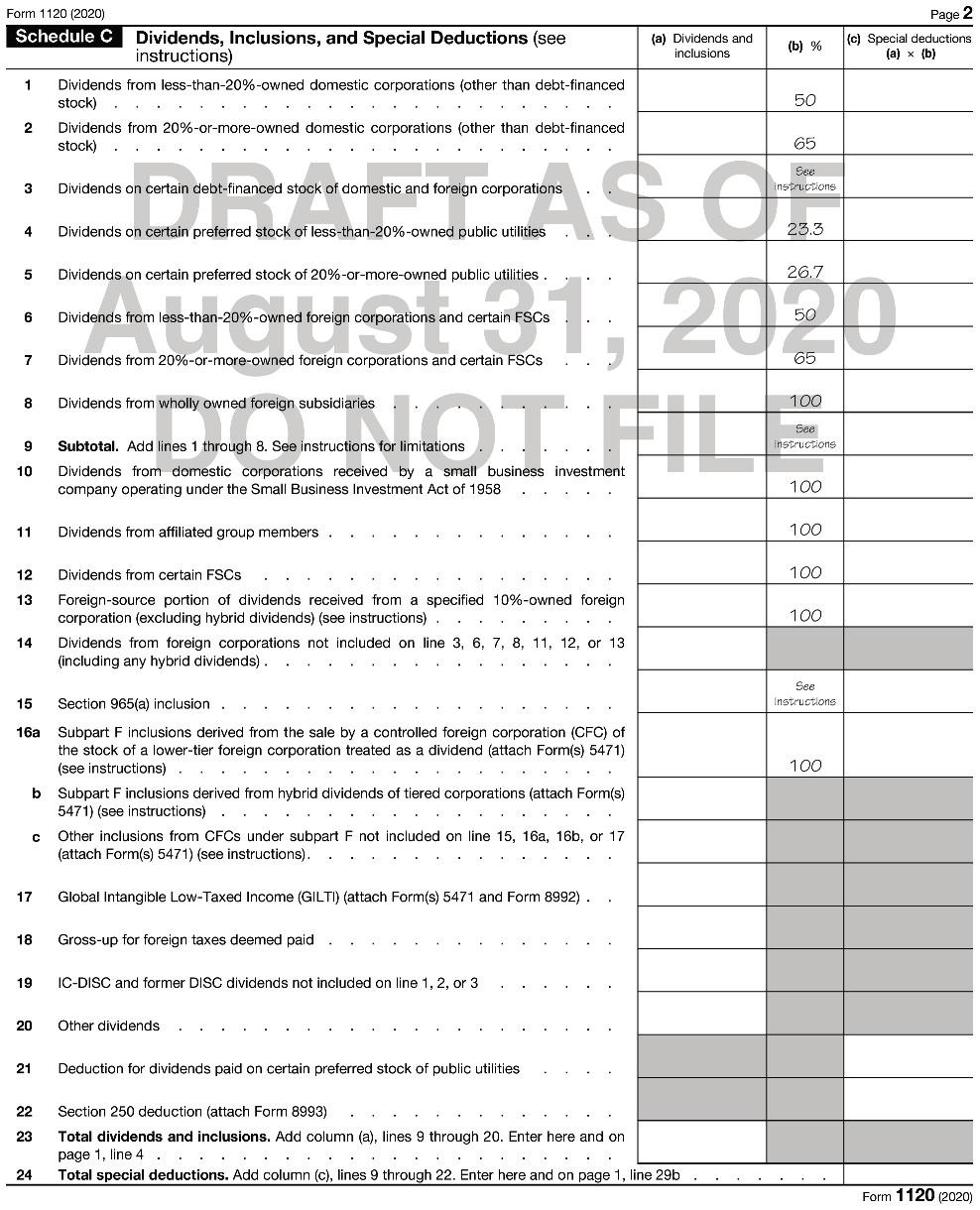

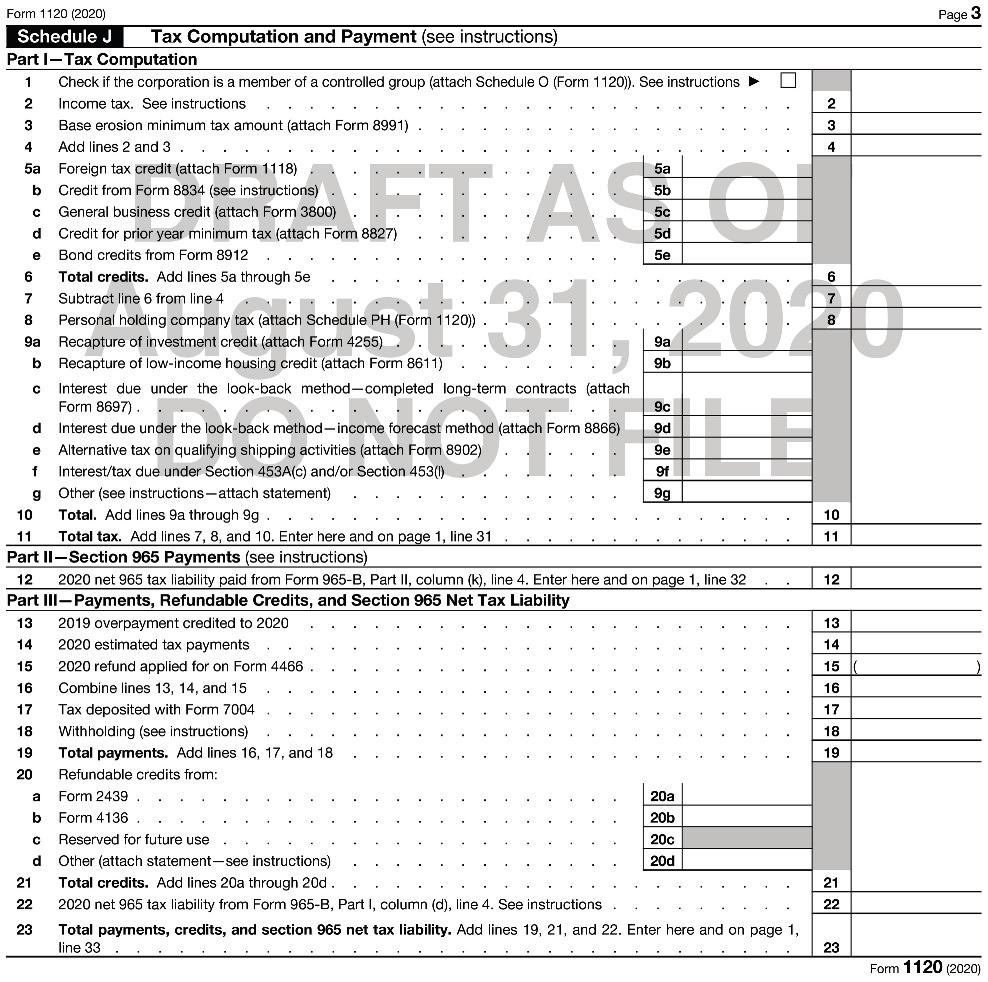

The corporation made estimated tax payments of $9,000. Complete Form 1120 for Floyd Corporation on Pages 11-43 through 11-48.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted: