Fly-By-Night (P.O. Box 1234, Dallas, TX 75221, EIN 12-9876543) paid George Smith, an employee who lives at

Question:

Fly-By-Night (P.O. Box 1234, Dallas, TX 75221, EIN 12-9876543) paid George Smith, an employee who lives at 432 Second Street, Garland, TX 75040, wages of $25,400. Based on George’s final 2018 pay stub, the income tax withholding amounted to $5,380 and the FICA tax was $1,943.10 ($1,574.80 for Social Security and $368.30 for Medicare). George’s FICA wages were the same as the total wages, and his Social Security number is 466-47-3313. Fly-By-Night’s owner, a shady character, took off to South America with all the firm’s funds, and did not file the required Forms W-2, etc., for George (and other employees). The above numbers are taken from the year-to date section of George’s last pay stub. Use the Form 4852 on Pages 9-47 and 9-48 to prepare a substitute Form W-2 for George.

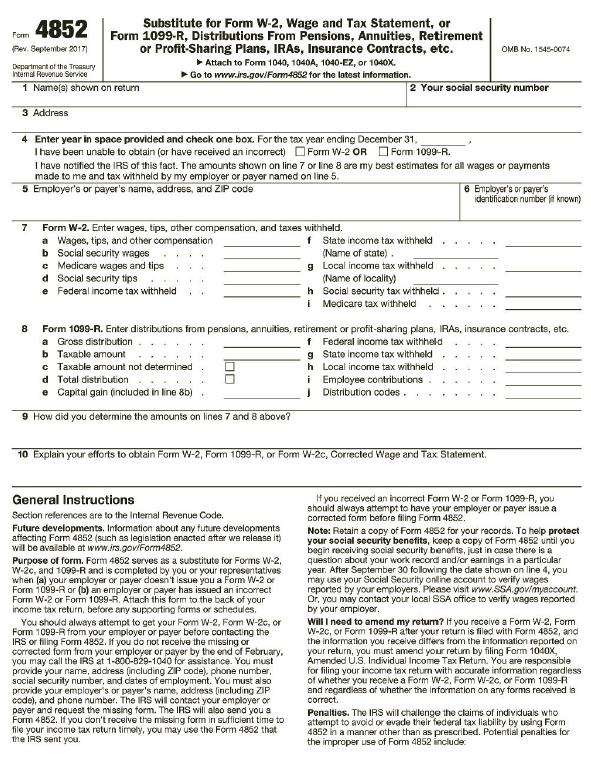

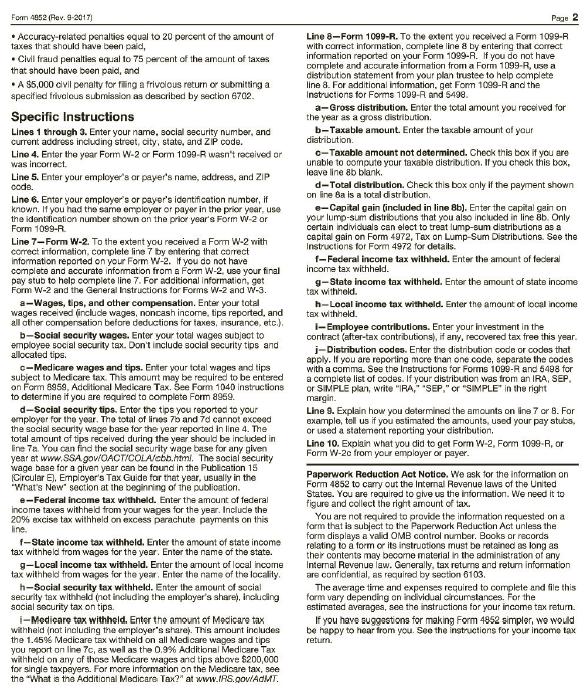

4852 Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAS, Insurance Contracts, etc. Form Per. September 2017 OMB No. 1545-0074 Departmant of the Troasury Intemal Revenue Service Attach to Fom 1040, 1040A, 1040-EZ, or 1040X. Go to www.irs.gov/Form4852 tor the latest information. 1 Name(s) shown on return 2 Your social security number 3 Address 4 Enter year in space provided and check one box. For the tax year ending December 31, I have been unable to obtain (or have received an incorrect) OForm W-2 OR OForm 1099-R. I have notified the IRS of this fact. The amounts shown on line 7 or line 8 are my best estimates for all wages or payments made to me and tax withheld by my employer or payer named on line 5. 5 Employer's or payer's name, address, and ZIP code 6 Employer's or payer's identification number if known) 7 Form W-2. Enter wages, tips, other compensation, and taxes withheld. a Wages, tips, and other compensation b Social security wages c Medicare wages and tips d Social security tips e Federal income tax withheld State income tax withheld (Name of state). 9 Local income tax withheld (Name of locality) h Social security tax withheld. i Medicare tax withheld Form 1099-R. Enter distributions from pensions, annuities, retirement or profit-sharing plans, IRAS, insurance contrects, etc. a Gross distribution b Taxable amount c Taxable amount not determined d Total distribution e Capital gain (included in line 8b) f Federal income tax withheld g State income tax withheld h Local income tax withheld i Employee contributions. Distribution codes. 9 How did you determine the amounts on lines 7 and 8 above? 10 Explain your efforts to obtain Form W-2, Form 1099-R, or Form Vw-2c, Corrected Wage and Tax Statement. If you received an incorrect Form W-2 or Form 1099-R, you should always attempt to have your employer or payer issue a corrected form before filing Form 4852. Note: Retain a copy of Form 4852 for your records. To help protect your social security benefits, koep a copy of Form 4852 until you begin receiving social security benefits, just in case there is a question about your work record and/or earnings in a particular year. After September 30 following the date shown on line 4, you may use your Social Security online account to verify wages reported by your employers. Please visit www.SSA.gov/myaccount. Or, you may contact your local SSA office to verify wages reported by your employer. General Instructions Section references are to the Internal Revenue Code. Future developments. Information about any future developments affecting Form 4852 (such as legislation enacted aftar we relesse it) will be available at www.irs.gov/Form4852. Purpose of form. Form 4852 serves as a substitute for Forms W-2, W-2c, and 1099-R and is completed by you or your representatives when (a) your employer or payer doesn't issue you a Form W-2 or Form 1099-R or (b) an employer or payer has issued an incorrect Form W-2 or Form 1099-R. Attach this form to the back of your income tax return, before any supporting forms or schedules. You should always attempt to get your Form W-2, Form W-2c, or Form 1099-R from your employer or payer before contacting the IRS or filing Form 4852. If you do not receive the missing or corrected form from your employer or payer by the end of February. you may call the IRS at 1-800-629-1040 for assistance. You must provide your name, address (including ZIP code), phone number, social security number, and dates of employment. You must also provide your employer's or payer's name, address (including ZIP code), and phone number. The IRS will contact your employer or peyer and request the missing form. The IRS will also send you a Form 4852. If you don't receive the missing form in sufficient time to file your income tax return timely, you may use the Form 4852 that the IRS sent you. Will I need to amend my retum? If you receive a Form W-2, Form W-20, or Form 1099-R after your return is filed with Form 4852, and the information you receive differs from the information reported on your return, you must amend your retum by filing Form 1040X, Amended U.S. Individual Income Tax Return. You are responsible for filing your income tax return with accurate information regardless of whether you receive a Form W-2, Form W-2c, or Form 1099-R and regardiess of whether the information on any forms received is correct. Penalties. The IRS will challenge the claims of individuals who attempt to avoid or evade their federal tax liability by using Form 4852 in a manner other than as prescribed. Potential penalties for the improper use of Form 4852 include

Step by Step Answer:

4852 Form Rev September 2017 Department of the Treasury Internal Revenue Service 1 Names shown on return George Smith 3 Address Substitute for Form W2 Wage and Tax Statement or Form 1099R Distributions From Pensions Annuities Retirement or ProfitSharing Plans IRAs Insurance Contracts etc Attach to Form 1040 1040A 1040EZ or 1040X Go to wwwirsgovForm4852 for the latest information 432 Second Street Garland TX 75040 4 Enter year in space provided and check one box For the tax year ending December 31 2018 I have been unable to obtain or have received an incorrect X Form W2 OR Form 1099R 7 8 I have notified the IRS of this fact The amounts shown on line 7 or line 8 are my best estimates for all wages or payments made to me and tax withheld by my employer or payer named on line 5 5 Employers or payers name address and ZIP code 2 Your social security number 466473313 FlyByNight PO Box 1234 Dallas TX 75221 Form W2 Enter wages tips other compensation and taxes withheld a Wages tips and other compensation 25400 f State income tax withheld b Social security wages c Medicare wages and tips 25400 Name of state 25400 g Local income tax withheld Name of locality d Social security tips e Federal income tax withheld 5380 Social security tax withheld c Taxable amount not determined d Total distribution ...View the full answer

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Students also viewed these Business questions

-

Using the income tax withholding table in Figure 3, pages 302 303, for each employee of Miller Company, determine the net pay for the week ended January 21. Assume a Social Security tax of 4.2...

-

A box has numbers from 1 to 10. A number is drawn at random. Let X1 be the number drawn. This number is replaced, and the ten numbers mixed. A second number X2 is drawn. Find the distributions of X1...

-

To form a reinforced box section, two rolled W sections and two plates are welded together. Determine the moments of inertia and the radii of gyration of the combined section with respect to the...

-

the IP address are for illustrative purposes only. Use your own IP addressing scheme (You may use classful and classless IP addresses as per your preference). Note that students need to attach the...

-

Mandalay Industries is a private company that sells electronic test equipment. During the year 2013, the inventory records reflected the following: Units Unit Cost Total Cost Beginning...

-

Use the Binomial Theorem to find the indicated coefficient or term. The coefficient x 3 in the expansion of (2x + 1) 12

-

To what degrees are endogamy and exogamy practiced within American society? What kinds of groups are endogamous and exogamous?

-

The IASB framework for preparing and presenting financial statements defines assets as resources controlled by an enterprise as a result of past events from which future economic benefits are...

-

In the figure a "semi-infinite" nonconducting rod (that is, infinite in one direction only) has uniform linear charge density = 5.19 C/m. Find (including sign) (a) the component of electric field...

-

Jane West, owner of West?s Stencilling Service in Grande Prairie, has requested that you prepare from the following balances? (a) An income statement for June 2020, (b) A statement of owner?s equity...

-

Kevin purchased a house 20 years ago for $100,000 and he has always lived in the house. Three years ago Kevin married Karen, and she has lived in the house since their marriage. If they sell Kevins...

-

Yamin operates a small business with a few part-time employees. Her annual employment tax withholding in 2018 is $467.80. Yamin should file which employment tax reporting form? a. Form 944 b. Form...

-

Discuss what is meant by upward influence and the various influence tactics categories associated with it.

-

1) Three-Asset Portfolio Calculate the expected return and standard deviation of the three-asset portfolio shown in the following figure: Amount invested Expected return Standard deviation...

-

Question 1 Draw a labor-leisure diagram with leisure on the horizontal axis, and earnings on the vertical axis, assuming the maximum hours of labor or leisure equals 4000 hours a year. Draw a budget...

-

A small business purchases a used airplane for $1,200,000; this is considered MACRS 5-year property. The business plans to keep the plane for the next 7 years. The business estimates that the...

-

A median voter model is defined as _ _ _ . A . None of the answer is correct. B . a model showing that there is a tendency for decision in a democracy to reflect the interests of a group of voters...

-

The company Fl sar og Parquet produces high - quality tiles. In 2 0 2 2 , the estimated purchase of material was 5 0 , 0 0 0 kg , which cost 1 0 0 ISK. per kilo. Actual purchase and use of material...

-

If the tax elasticity of labor supply is 0.20, by what percentage will the quantity of labor supplied increase in response to (a) A $500 per person income tax rebate? (b) A 4 percent reduction in...

-

Solve each equation or inequality. |6x8-4 = 0

-

Which of the following prizes or awards is taxable? a. Professional sports awards b. Prizes from a television game show c. Awards for superior performance on the job d. A one-acre lot received as a...

-

For 2016, the minimum percentage of Social Security benefits that could be included in a taxpayers gross income is: a. 0% b. 25% c. 50% d. 75% e. 85%

-

For 2016, the minimum percentage of Social Security benefits that could be included in a taxpayers gross income is: a. 0% b. 25% c. 50% d. 75% e. 85%

-

4. The regular air fare between Boston and San Francisco is 419. An airline using planes on this route observes that they fly with an average of 236 passengers. Market research tells the airlines'...

-

What is Progressive ? s proportional profit margin in 1 9 9 ? For example, for each $ 1 0 0 dollars in revenues, what is Progressive ? s profit or loss? Exhibit 5 Progressive Selected Financials ($...

-

What are the geopolitical ramifications of social networks in terms of their role in political activism, information warfare, and the spread of ideological extremism ?

Study smarter with the SolutionInn App