In 2018, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint

Question:

In 2018, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint tax return with AGl of $25,400. During the year they incurred the following expenses:

Medical insurance premiums....................$1,150

Premiums on an insurance policy that pays $100 per

day for each day....................400

Margaret is hospitalized

Medical care lodging (two people, one night)....................65

Hospital bills....................2,100

Doctor bills....................850

Dentist bills....................175

Prescription drugs and medicines....................340

Psychiatric care....................350

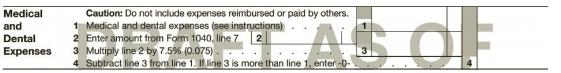

In addition, they drove 83 miles for medical transportation, and their insurance company reimbursed them $900 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy’s medical expense deduction.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill