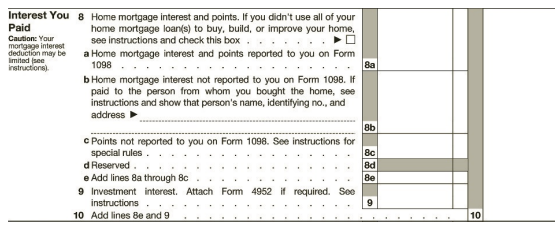

Ken paid the following amounts for interest during 2018: 3 Qualified interest on home mortgage.................$4,800 Auto loan

Question:

Ken paid the following amounts for interest during 2018: 3

Qualified interest on home mortgage.................$4,800

Auto loan interest.................850

“Points” on the mortgage for acquisition of his personal residence.................400

Service charges on his checking account.................40

Mastercard interest.................300

Calculate Ken’s itemized deduction for interest on the following portion of Schedule A.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted: