Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients

Question:

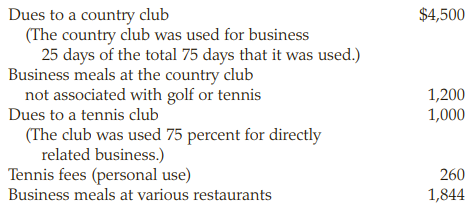

Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in 2018:

a. How much is Marty’s deduction for entertainment expenses for 2018? $ __________

b. For each item listed above that you believe is not allowed as a deduction, explain the reason it is not allowed.

Transcribed Image Text:

Dues to a country club (The country club was used for business 25 days of the total 75 days that it was used.) Business meals at the country club not associated with golf or tennis Dues to a tennis club $4,500 1,200 1,000 (The club was used 75 percent for directly related business.) Tennis fees (personal use) 260 Business meals at various restaurants 1,844

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

a Business meals at the country club 1200 Business meals at various resta...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During the year, Brenda has the following expenses related to her employment. Airfare ............................................................................... $8,500 Meals...

-

A&J Co. incurred the following expenses related to patented drugs. 1. Indicate costs that are reported as research and development expenses on the income statement. 2. Indicate costs that are...

-

Can Joe Corporation deduct the following expenses related to its business? a. Legal fee paid ($40,000) to acquire a competing chain of stores b. Legal fee paid ($12,000) to determine whether it...

-

Amie, Inc., has 100,000 shares of $2 par value stock outstanding. Prairie Corporation acquired 30,000 of Amie's shares on January 1, 2015, for $120,000 when Amie's net assets had a total fair value...

-

Using the transactions in CP5-1, complete the following table by indicating the sign of the effect (+ for increase, - for decrease, NE for no effect, and CD for cannot determine) of each transaction....

-

Show that each sequence is geometric. Then find the common ratio and write out the first four terms. {()} 5 {bn}

-

What are some key fallacies of attempts to divide people into biological races?

-

ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR UNDERAPPLIED/ OVERAPPLIED FACTORY OVERHEAD Prepare the December 31 adjusting journal entries for Johnson Company. Data are as follows: (a) Factory overhead...

-

1) The December 31, 2024, balance sheet of Garcia Company included the following: Common stock, 20 million shares outstanding at $1 par Paid-in capital-excess of par Retained earnings $20,000,000...

-

On February 1, 2017, Strawberry Corp. factored receivables with a carrying amount of $250,000 to Shortcake Inc. Shortcake assessed a finance charge of 3% of the receivables and retained 5% of the...

-

Which of the following taxpayers may not deduct their educational expense? a. A CPA who attends a course to review for the real estate agents exam. b. An independent sales representative who attends...

-

Which of the following is not likely to be a deductible expense? a. The cost of tickets to a stage play for a client and the taxpayer. b. The cost for Rosa to take a potential customer to lunch to...

-

Evaluate the following limits using Taylor series. lim x(e'/* 1) 1/x |x

-

Question 8 (2 points) Saved Find the 10-K for Hewlett-Packard for 2019; calculate Days Inventory. Hint....for cost of goods sold, look for cost of revenue. What is the answer for Days Inventory? 15%...

-

Convert the following nested if statement to if/else if statement if (numBooks=1) numCoupons - 1: if (numBooks> 1) if (numBooks <5) numCoupons - 3; else numCoupons 4: 1000

-

10. Provide a topological sort to show a total order over the following Hasse diagram. m b

-

To dynamically change a reference line using a parameter action, you first create a reference parameter. Next, add a parameter action for it . Finally, ` _ _ _ _ _ ` . Select an answer: Add a URL...

-

The recursive formula for Binomial Coefficient C(n, k) is given by C(n, k) = C(n-1, k-1)+ C(n-1, k). Consider the following dynamic programming implementation for Binomial Coefficient. Which of the...

-

If the Federal Reserve banks mailed everyone a brand-new $100 bill, what would happen to prices, output, and income? Illustrate your answer by using the equation of exchange.

-

Research corporate acquisitions using Web resources and then answer the following questions: Why do firms purchase other corporations? Do firms pay too much for the acquired corporation? Why do so...

-

Charlies Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2018 customer billings for lawn care into the next year. In...

-

The Au Natural Clothing Corporation has changed its year-end from a calendar yearend to March 31, with permission from the IRS. The income for its short period from January 1 to March 31 is $24,000....

-

Barbara donates a painting that she purchased three years ago for $8,000, to a university for display in the presidents office. The fair market value of the painting on the date of the gift is...

-

Write a MATLAB code/script which includes a row vector named your first name constructed with square brackets consisting of the digits in your student number in order and calculates the sum of the...

-

Write a MATLAB code/script includes calling a function named your first name which returns the area and volume of a cylinder. This code prompts the user to enter the radius (r) and height (h) values...

-

2.1 Explain by means of drawings how the Successive-Approximation conversion process takes place when receiving an analog voltage input. Use the KEEP/RESET method. Use 5 V input. Vref= 8 V (10) 2.2...

Study smarter with the SolutionInn App