Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social

Question:

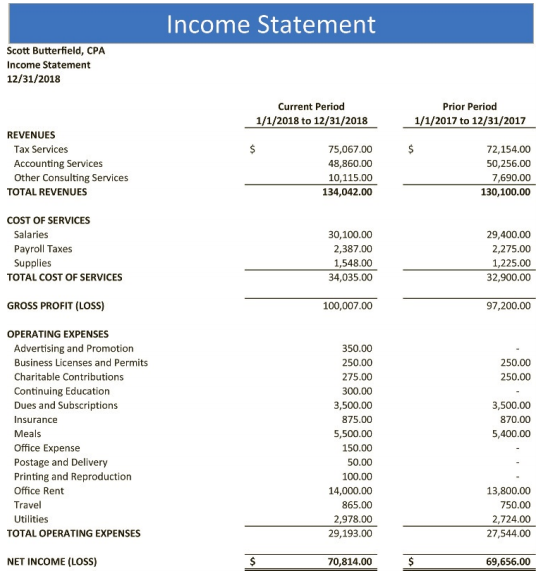

Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security number is 644-47-7833. His principal business code is 541211. Scott’s CPA practice is located at 678 Third Street, Riverside, CA 92860. Scott’s income statement for the year shows the following:

Scott also mentioned the following:

- The expenses for dues and subscriptions were his country club membership dues for the year.

- The charitable contributions were made to a political action committee.

- Scott does not generate income from the sale of goods and therefore does not record supplies and wages as part of cost of goods sold.

- Scott placed a business auto in service on January 1, 2015 and drove it 3,829 miles for business, 3,250 miles for commuting, and 4,500 miles for nonbusiness purposes. His wife has a car for personal use. Complete Schedule C on Pages 3-41 and 3-42 for Scott showing Scott’s net income from self-employment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted: