In this problem, you will process transactions involving fixed assets for Savoy Merchandise Co. for the month

Question:

Step 1: Start Integrated Accounting 8e.

Step 2: Load the opening balances template file, IA8 Problem 06-A.

Step 3: Enter your name in the Your Name text box and click OK.

Step 4: Save the data to your disk as 06-A Your Name.

Step 5: Delete asset no. 200, CP85 Ink Jet Printer.

Step 6: Change the name of asset no. 280 to Facsimile Machine.

Step 7: Enter the fixed asset data in Account Maintenance.

Fixed Assets Transactions

Nov. 04, 2013

Purchased a Binding Machine for $509.99; asset number, 215; depreciation method, double-declining balance; useful life, 6 years; salvage value, $50.00; accumulated depreciation, account number 1521; depreciation expense, account number 6520.

Nov. 10, 2013

Purchased a K6 Telephone System for $5,150.00; asset number, 290; depreciation method, straight-line; useful life, 7 years; salvage value, $515.00; accumulated depreciation, account number 1521; depreciation expense, account number 6520.

Nov. 12, 2013

Purchased a File Cabinet for $395.00; asset number, 370; depreciation method, MACRS; useful life, 7 years; salvage value, $45.00; accumulated depreciation, account number 1531; depreciation expense, account number 6525.

Nov. 14, 2013

Purchased Shelving for $589.95; asset number 380; depreciation method, straight-line; useful life, 10 years; salvage value, $75.00; accumulated depreciation, account number 1531; depreciation expense, account number 6525.

Nov. 20, 2013

Purchased a Pickup Truck for $12,000.00; asset number, 140; depreciation method, straight-line; useful life, 5 years; salvage value, $1,800.00; accumulated depreciation, account number 1511; depreciation expense, account number 6130.

Step 8: Use the general journal to enter and post the following assets to the general ledger.

Nov. 01, 2013

Discarded asset no. 200, CP85 Ink Jet Printer (Office Equipment) bought in January, 2007: cost, $375.00; total accumulated depreciation recorded to December 31, 2011, $375.00. Memo No. 113.

Nov. 04, 2013

Paid cash for Binding Machine, $509.99; Check No. 3839.

Nov. 10, 2013

Paid cash for K6 Telephone System, $5,150.00; Check No. 3840.

Nov. 12, 2013

Paid cash for File Cabinet, $395.00; Check No. 3841.

Nov. 14, 2013

Paid cash for Shelving, $589.95; Check No. 3842.

Nov. 20, 2013

Paid cash for Pickup Truck, $12,000.00; Check No. 3843.

Nov. 25, 2013

Paid cash for HC-2530 Computer, $2,785.00; Check No. 3844.

Step 9: Display a General Journal report.

(Make sure the date on the Report Selection menu is set to 11/30/13.)

Step 10: Display a fixed assets list.

Step 11: Display a depreciation schedule for each of the new assets purchased in November.

Step 12: Display the trial balance.

End-of-Month Activities

The depreciation adjusting entries are automatically generated from the fixed assets information. The rest of the adjusting entries must be entered separately into the computer. Savoy Merchandise Co., had the following adjustment data for November.

Insurance expired during November ........... $ 345.00

Inventory of supplies on November 30 ....... $2,235.00

Step 1: Enter the adjusting entries.

Step 2: Generate and post the depreciation adjusting entries.

Step 3: Display the adjusting entries (use 11/30/13 as both the start and end dates).

Step 4: Use Check on the toolbar to check your work.

Step 5: Display the income statement.

Step 6: Display the statement of owner€™s equity.

Step 7: Display the balance sheet.

Step 8: Generate Depreciation Comparison graphs for the K6 Telephone

System and the Pickup Truck.

Step 9: Save your data to disk.

Step 10: Optional spreadsheet integration activity.

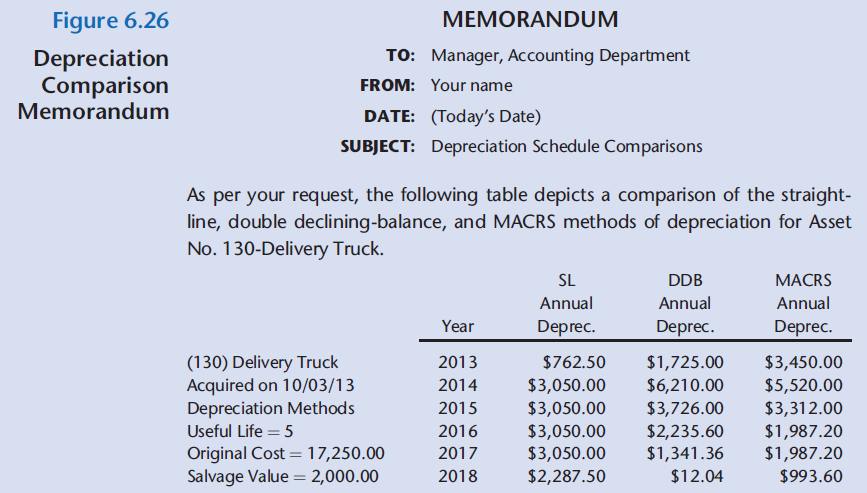

Generate depreciation schedules for asset 140-Pickup Truck using each of the three depreciation methods discussed in this chapter. Copy and paste each schedule into a spreadsheet template to obtain comparison information.

a. Display and copy the depreciation schedule for asset 140-Pickup Truck to the clipboard in spreadsheet format.

b. Start your spreadsheet software and load template file IA8 Spreadsheet 06-S.

c. Select cell A1 as the current cell and paste the Pickup Truck depreciation schedule into the spreadsheet.

d. Copy the year from cells B10-B15 to cells B29-B34. Copy the annual depreciation from cells C10-C15 to the appropriate column (i.e., copy to cells C29-C34 if the depreciation schedule uses the straight-line method, copy to cells D29-D34 if the double-declining-balance method is used, and so on).

e. Return to Integrated Accounting 8e, click Accts. on the toolbar, and change the depreciation method for asset 140-Pickup Truck. Repeat steps c and d for each of the remaining depreciation methods.

f. Print the comparison report (cells A22-F34).

g. Save the spreadsheet data to your disk with a file name of 06-A Your Name. Do not save the changed Integrated Accounting 8e data.

Step 11: Optional word processing integration activity.

Prepare a memorandum to the manager of the accounting department that shows depreciation comparison information from the preceding spreadsheet activity.

a. Start your word processing software application and create a new document. (If your software has templates, load a memorandum format.)

b. Enter the memorandum heading information using Figure 6.26 as a guide. Copy and paste the spreadsheet comparison report (cells A26-F34) into the body of the memorandum.

c. Print the memorandum.

d. Save the memorandum to your disk with a file name of 06-A Your Name.

e. End your word processing and spreadsheet sessions.

Step 12: End the Integrated Accounting 8e session. (Do not save the data.)

Step by Step Answer:

Integrated Accounting

ISBN: 978-1285462721

8th edition

Authors: Dale A. Klooster, Warren Allen, Glenn Owen