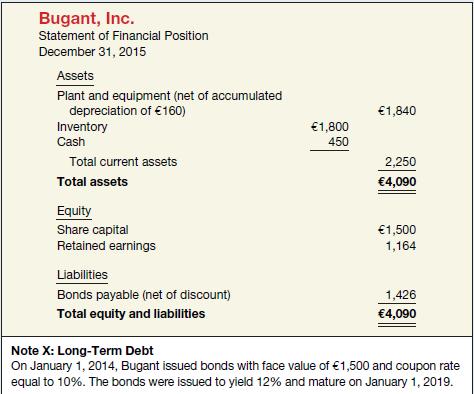

Accounting, Analysis, and Principles The following information is taken from the 2015 annual report of Bugant, Inc.

Question:

Accounting, Analysis, and Principles The following information is taken from the 2015 annual report of Bugant, Inc. Bugant’s fiscal year ends December 31 of each year.

Additional information concerning 2016 is as follows.

1. Sales were €2,922, all for cash.

2. Purchases were €2,000, all paid in cash.

3. Salaries were €700, all paid in cash.

4. Plant and equipment was originally purchased for €2,000 and is depreciated on a straight-line basis over a 25-year life with no residual value.

5. Ending inventory was €1,900.

6. Cash dividends of €100 were declared and paid by Bugant.

7. Ignore taxes.

8. The market rate of interest on bonds of similar risk was 16% during all of 2016.

9. Interest on the bonds is paid semiannually each June 30 and December 31.

Accounting Prepare an income statement for Bugant, Inc. for the year ending December 31, 2016, and a statement of financial position at December 31, 2016. Assume semiannual compounding.

Analysis Use common ratios for analysis of long-term debt to assess Bugant’s long-run solvency. Has Bugant’s solvency changed much from 2015 to 2016? Bugant’s net income in 2015 was €550 and interest expense was €169.39.

Principles Recently, the FASB and the IASB allowed companies the option of recognizing in their financial statements the fair values of their long-term debt. That is, companies have the option to change the statement of financial position value of their long-term debt to the debt’s fair (or market) value and report the change in statement of financial position value as a gain or loss in income. In terms of the qualitative characteristics of accounting information (Chapter 2), briefly describe the potential trade-off(s) involved in reporting long-term debt at its fair value.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield