Logan Industries purchased the following assets and constructed a building as well. All this was done during

Question:

Logan Industries purchased the following assets and constructed a building as well. All this was done during the current year.

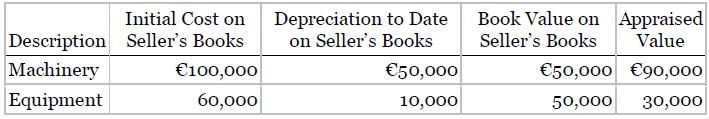

Assets 1 and 2: These assets were purchased at a lump sum for €104,000 cash. The following information was gathered.

Asset 3: This machine was acquired by making a €10,000 down payment and issuing a €30,000, 2-year, zero-interest-bearing note. The note is to be paid off in two €15,000 installments made at the end of the first and second years. It was estimated that the asset could have been purchased outright for €35,900.

Asset 4: This machinery was acquired by trading in used machinery. The exchange lacks commercial substance. Facts concerning the trade-in are as follows.

Cost of machinery traded ........................................ €100,000

Accumulated depreciation to date of sale ................. 36,000

Fair value of machinery traded ................................... 80,000

Cash received ................................................................ 10,000

Fair value of machinery acquired ............................... 70,000

Asset 5: Equipment was acquired by issuing 100 shares of €8 par value ordinary shares. The shares have a market price of €11 per share.

Construction of Building: A building was constructed on land with a cost of €180,000. Construction began on February 1 and was completed on November 1. The payments to the contractor were as follows.

Date ............. Payment

2/1 ................ €120,000

6/1 .................. 360,000

9/1 .................. 480,000

11/1 ............... 100,000

To finance construction of the building, a €600,000, 12% construction loan was taken out on February 1. The loan was repaid on November 1. The firm had €200,000 of other outstanding debt during the year at a borrowing rate of 8%.

Instructions

Record the acquisition of each of these assets. Interest expense for the year has been recorded.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield