McEntire Corporation began operations on January 1, 2012. During its first 3 years of operations, McEntire reported

Question:

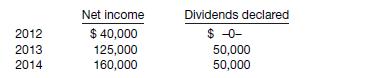

McEntire Corporation began operations on January 1, 2012. During its first 3 years of operations, McEntire reported net income and declared dividends as follows.

The following information relates to 2015.

Income before income tax $220,000 Prior period adjustment: understatement of 2013 depreciation expense (before taxes) $ 25,000 Cumulative decrease in income from change in inventory methods (before taxes) $ 45,000 Dividends declared (of this amount, $25,000 will be paid on Jan. 15, 2016) $100,000 Effective tax rate 20%

Instructions

(a) Prepare a 2015 retained earnings statement for McEntire Corporation.

(b) Assume McEntire Corp. restricted retained earnings in the amount of $70,000 on December 31, 2015. After this action, what would McEntire report as total retained earnings in its December 31, 2015, statement of financial position?

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield