Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on

Question:

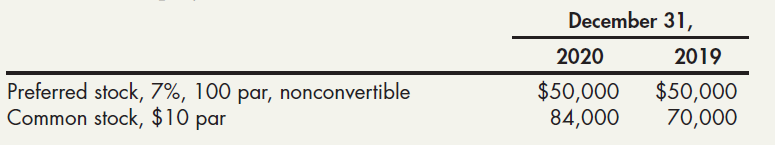

Anoka Company reported the following selected items in the shareholders’ equity section of its balance sheet on December 31, 2019, and 2020:

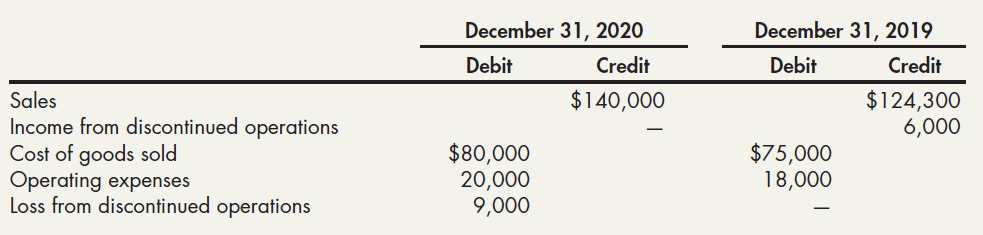

In addition, it listed the following selected pretax items as of December 31, 2019 and 2020:

The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock

dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for $25.75 and $32.20, respectively. The company is subject to a 30% income tax rate.

Required:

1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anoka’s 2020 annual report.

2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach