At the end of 2025, Sawyer Company is conducting an impairment test and needs to develop a

Question:

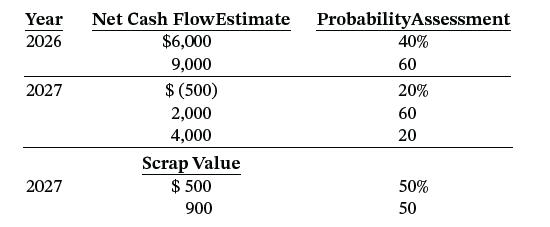

At the end of 2025, Sawyer Company is conducting an impairment test and needs to develop a fair value estimate for machinery used in its manufacturing operations. Given the nature of Sawyer’s production process, the equipment is for special use. The equipment will be obsolete in 2 years, and Sawyer’s accountants have developed the following cash flow information for the equipment.

Murphy Mining Company recently purchased a quartz mine that it intends to work for the next 10 years. According to state environmental laws, Murphy must restore the mine site to its original natural prairie state after it ceases mining operations at the site. To properly account for the mine, Murphy must estimate the fair value of this asset retirement obligation. This amount will be recorded as a liability and added to the value of the mine on Murphy’s books. There is no active market for retirement obligations such as these, but Murphy has developed the following cash flow estimates based on its prior experience in mining-site restoration. It will take 3 years to restore the mine site when mining operations cease in 10 years. Each estimated cash outflow reflects an annual payment at the end of each year of the 3-year restoration period.

Using expected cash flow and present value techniques, determine the fair value of the machinery at the end of 2025. Use a 6% discount rate. Assume all cash flows occur at the end of the year.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield