From inception of operations to December 31, 2025, Fortner Corporation provided for uncollectible accounts receivable under the

Question:

From inception of operations to December 31, 2025, Fortner Corporation provided for uncollectible accounts receivable under the allowance method. The provisions are recorded, based on analyses of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account, and no year-end adjustments to the allowance account were made. Fortner’s usual credit terms are net 30 days.

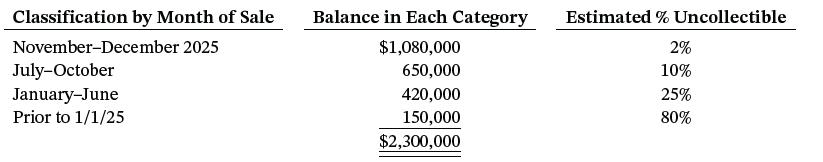

The balance in Allowance for Doubtful Accounts was $130,000 (Cr.) at January 1, 2025. During 2025, credit sales totaled $9,000,000, the provision for doubtful accounts was determined to be $180,000, $90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $15,000. Fortner installed a computer system in November 2025, and an aging of accounts receivable was prepared for the first time as of December 31, 2025. A summary of the aging is as follows.

Based on the review of collectibility of the account balances in the “prior to 1/1/25” aging category, additional receivables totaling $60,000 were written off as of December 31, 2025. The 80% uncollectible estimate applies to the remaining $90,000 in the category. Effective with the year ended December 31, 2025, Fortner adopted a different method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Instructions

a. Prepare a schedule analyzing the changes in Allowance for Doubtful Accounts for the year ended December 31, 2025. Show supporting computations in good form. (In computing the 12/31/25 allowance, subtract the $60,000 write-off.)

b. Prepare the journal entry for the year-end adjustment to Allowance for Doubtful Accounts balance as of December 31, 2025.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield