On January 1, 2019, Vasby Software Company adopted a healthcare plan for its retired employees. To determine

Question:

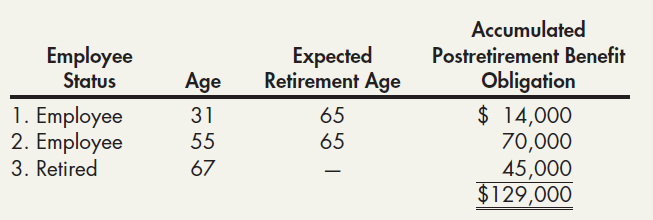

On January 1, 2019, Vasby Software Company adopted a healthcare plan for its retired employees. To determine eligibility for benefits, Vasby retroactively gives credit to the date of hire for each employee. The service cost for 2019 is $8,000. The plan is not funded, and the discount rate is 10%. All employees were hired at age 28 and become eligible for full benefits at age 58. Employee C was paid $7,000 for postretirement healthcare benefits in 2019. On December 31, 2019, the accumulated postretirement benefit obligation for Employees B and C were $77,000 and $41,500, respectively. Additional information on January 1, 2019, is as follows:

Required:

1. Compute the OPRB expense for 2019 if Vasby uses the average remaining service life to amortize the prior service cost.

2. Prepare all the required journal entries for 2019 if the plan is not funded.

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach