Penn Company was formed on July 1, 2023. It was authorized to issue 300,000 shares of $10

Question:

Penn Company was formed on July 1, 2023. It was authorized to issue 300,000 shares of $10 par value common stock and 100,000 shares of 8%, $25 par value, cumulative and nonparticipating preferred stock. Penn Company has a July 1–June 30 fiscal year.

The following information relates to the stockholders’ equity accounts of Penn Company.

Common Stock

Prior to the 2025–2026 fiscal year, Penn Company had 110,000 shares of outstanding common stock issued as follows.

1. 85,000 shares were issued for cash on July 1, 2023, at $31 per share.

2. On July 24, 2023, 5,000 shares were exchanged for a plot of land which cost the seller $70,000 in 2017 and had a fair value (based on recent land sales) of $220,000 on July 24, 2023.

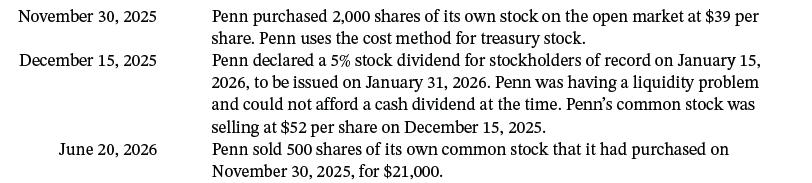

3. 20,000 shares were issued on March 1, 2024, for $42 per share. During the 2025–2026 fiscal year, the following transactions regarding common stock took place.

Preferred Stock

Penn issued 40,000 shares of preferred stock at $44 per share on July 1, 2024.

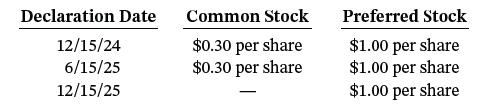

Cash Dividends

Penn has followed a schedule of declaring cash dividends in December and June, with payment being made to stockholders of record in the following month. The cash dividends which have been declared since inception of the company through June 30, 2026, are shown below.

No cash dividends were declared during June 2026 due to the company’s liquidity problems.

Retained Earnings

As of June 30, 2025, Penn’s retained earnings account had a balance of $690,000. For the fiscal year ending June 30, 2026, Penn reported net income of $40,000.

Instructions

Prepare the stockholders’ equity section of the balance sheet, including appropriate notes, for Penn Company as of June 30, 2026, as it should appear in its annual report to the shareholders.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield