Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating

Question:

Refer to the information for Farrell Corporation in P21-13.

Required:

1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows.

2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

P21-13.

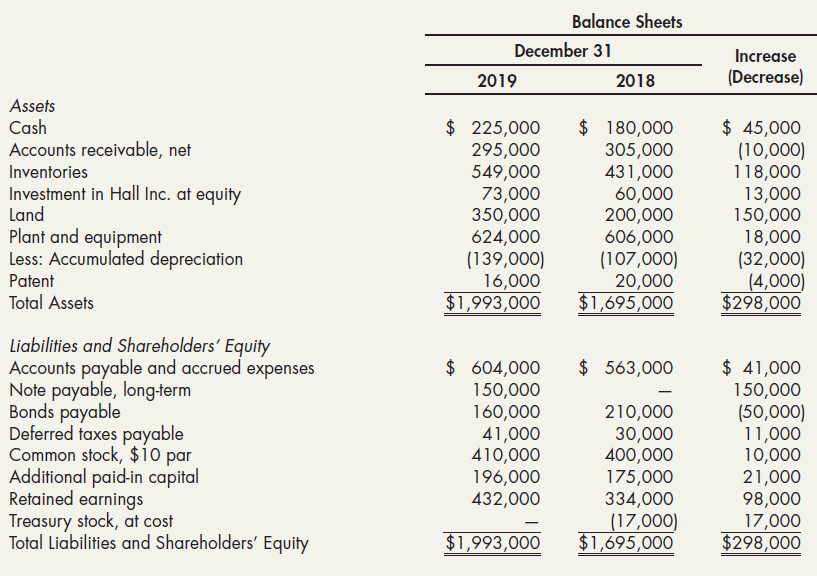

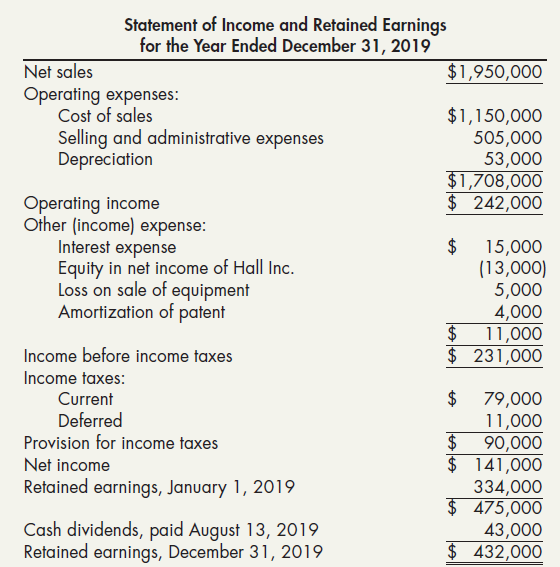

The following are Farrell Corporation’s balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019:

Additional information:

a. On January 2, 2019, Farrell sold equipment costing $45,000, with a book value of $24,000, for $19,000 cash.

b. On April 2, 2019, Farrell issued 1,000 shares of common stock for $23,000 cash.

c. On May 14, 2019, Farrell sold all of its treasury stock for $25,000 cash.

d. On June 1, 2019, Farrell paid $50,000 to retire bonds with a face value (and book value) of $50,000.

e. On July 2, 2019, Farrell purchased equipment for $63,000 cash.

f. On December 31, 2019, land with a fair market value of $150,000 was purchased through the issuance of a long-term note in the amount of $150,000. The note bears interest at the rate of 15% and is due on December 31, 2021.

g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach