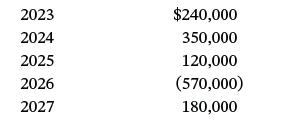

Wangerin Company reported the following pretax financial income (loss) for the years 2023 2027. Pretax financial income

Question:

Wangerin Company reported the following pretax financial income (loss) for the years 2023 2027.

Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate was 34% for 2023 and 2024, and 20% for 2025–2027. Assume the carryback provision is used first for net operating losses.

Instructions

a. Prepare the journal entries for the years 2025–2027 to record income tax expense, income taxes payable (refundable), and the tax effects of the loss carryback and loss carryforward, assuming no valuation allowance is needed.

b. Prepare the income tax section of the 2026 income statement beginning with the line “Income (loss) before income taxes.”

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield