Wilcox Company has prepared the following reconciliation of its pretax financial income with its taxable income for

Question:

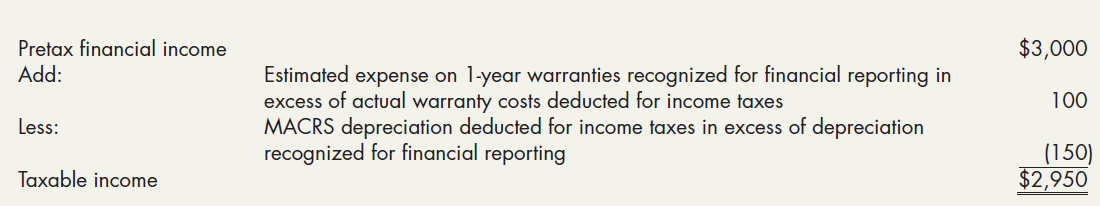

Wilcox Company has prepared the following reconciliation of its pretax financial income with its taxable income for 2019:

At the beginning of 2019, Wilcox had a deferred tax liability of $495. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. At the end of 2019, Wilcox anticipates that actual warranty costs will exceed estimated warranty expense by $100 next year and that financial depreciation will exceed tax depreciation by $1,800 in future years. Wilcox has earned income in all past years and expects to earn income in the future.

Required:

1. Prepare Wilcox’s income tax journal entry at the end of 2019.

2. Prepare the lower portion of Wilcox’s 2019 income statement.

3. Show how the income tax items are reported on Wilcox’s December 31, 2019, balance sheet.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach