Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and

Question:

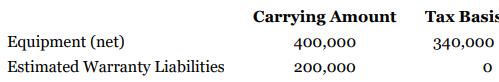

Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and the tax bases of its assets and liabilities at the end of 2020.

It is estimated that the warranty liability will be settled in 2021. The difference in equipment (net) will result in future taxable amounts of $20,000 in 2021, $30,000 in 2022, and $10,000 in 2023. The company has taxable income of $520,000 in 2020. As of the beginning of 2020, the enacted tax rate is 30% for 2020 to 2022 and 25% for 2023. Adelphi expects to report taxable income through 2023.

Instructions

a. Prepare the journal entry to report current and deferred income tax expense.

b. Indicate how deferred income taxes would be reported on the statement of financial position and balance sheet at the end of 2020 under IFRS and ASPE, respectively.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy