Bright Designs Ltd. began operations in 20X5 and, at the end of its first year of operations,

Question:

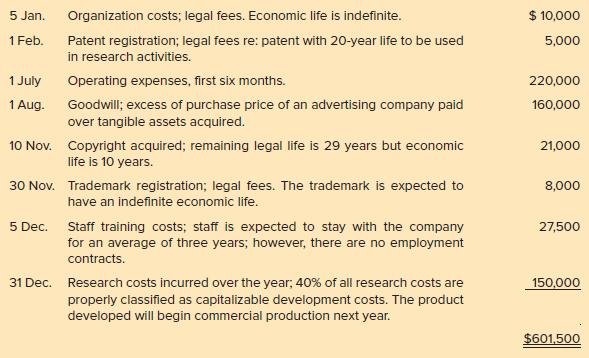

Bright Designs Ltd. began operations in 20X5 and, at the end of its first year of operations, reported a balance of $601,500 in an account called “intangibles.” Upon further investigation, it is discovered that the account had been debited throughout the year as follows:

Required:

1. Prepare a correcting entry that reallocates all amounts charged to intangibles to the appropriate accounts. State any assumptions made.

2. Calculate amortization expense on intangible assets for 20X5. Straight line amortization, to the exact month of purchase, is used. All residual values are expected to be zero.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick

Question Posted: