Cypress Company has an October 31 fiscal year end and prepares adjusting entries on an annual basis.

Question:

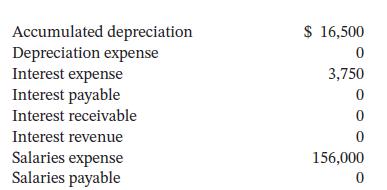

Cypress Company has an October 31 fiscal year end and prepares adjusting entries on an annual basis. The October 31, 2024, trial balance included the following selected accounts:

Additional information for its October 31, 2024, year-end adjustments:

1. Cypress has a two-year, 3.75% note receivable for $60,000 that was issued on May 1, 2024. Interest is payable every six months, on November 1 and May 1. Principal is payable at maturity. Cypress collected the correct amount on November 1, 2024.

2. Accrued salaries as at October 31, 2024, were $3,200. Payroll totalling $6,000 was paid on November 6, 2024.

3. Cypress has a five-year, 5% note payable for $90,000 issued in 2018. Interest is payable quarterly on March 1, June 1, September 1, and December 1 each year. Cypress paid the correct amounts during 2024.

4. Depreciation expense for the year ended October 31, 2024, was $5,500.

Instructions

a. Prepare T accounts and record the October 31, 2024, balances.

b. Prepare and post adjusting journal entries for items 1 to 4 above.

c. Prepare entries to close these revenue and expense accounts. Post to the T accounts.

d. Prepare and post reversing journal entries on November 1, 2024, as appropriate.

e. Prepare and post the journal entries to record the cash receipts or payments that occurred in November and December 2024. It is not necessary to post to the Cash account.

Taking It Further

Comment on the usefulness of reversing entries.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak