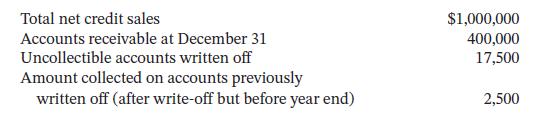

Information on Hohenberger Company for 2024 follows: Instructions a. Assume that Hohenberger Company decides to estimate its

Question:

Information on Hohenberger Company for 2024 follows:

Instructions

a. Assume that Hohenberger Company decides to estimate its uncollectible accounts using the allowance method and an aging schedule. Uncollectible accounts are estimated to be $24,000. What amount of bad debt expense will Hohenberger Company record if Allowance for Doubtful Accounts had an opening balance of $20,000 on January 1, 2024?

b. Assume the same facts as in part (a) except that the Allowance for Doubtful Accounts had a $12,000 balance on January 1, 2024. What amount of bad debt expense will Hohenberger record on December 31, 2024?

c. How does the amount of accounts written off during the period affect the amount of bad debt expense recorded at the end of the period when using the percentage of receivables approach?

d. How does the collection of an account that had previously been written off affect the carrying amount of accounts receivable?

Taking It Further

Hohenberger would like to speed up the collection of accounts receivable balances. What are two ways a company could do this? What are the advantages and disadvantages of each?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak