Kamsky Inc., which follows IFRS, had the following balances and amounts on its comparative financial statements at

Question:

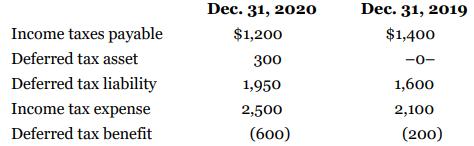

Kamsky Inc., which follows IFRS, had the following balances and amounts on its comparative financial statements at year end:

(a) Calculate income taxes paid in 2020 and discuss the related disclosure requirements under IFRS, if any.

(b) If Kamsky followed ASPE instead of IFRS, would the disclosure requirements for income taxes paid be any different?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Question Posted: