Milton Companys year end is July 31. Milton prepares adjusting entries to accrue interest revenue annually. On

Question:

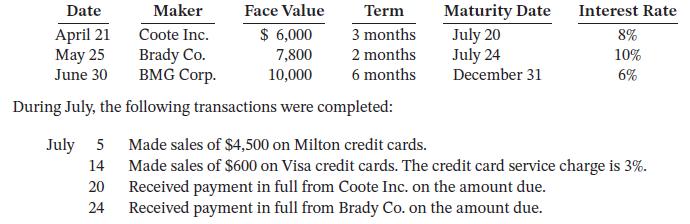

Milton Company’s year end is July 31. Milton prepares adjusting entries to accrue interest revenue annually. On June 30, the Notes Receivable account balance is $23,800 and the Credit Card Receivables account balance was zero. Notes receivable are as follows:

Instructions

a. Prepare journal entries for the July transactions and the July 31 adjusting entry for accrued interest revenue. (omit cost of goods sold entries.)

b. Prepare T accounts for Notes Receivable and Credit Card Receivables and enter the balances at July 1. Post the entries prepared in part (a).

c. Show the balance sheet presentation of the receivable accounts at July 31, 2024.

Taking It Further

The sales manager at Milton is confused about why some customer transactions are recorded as Accounts Receivable, some are recorded as Credit Card Receivables, and yet others are recorded as Notes Receivable. Explain the difference in the nature and accounting for each of these receivable accounts to the sales manager.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak