On October 31, 2024, the account balances of Hamm Equipment Repair were as follows. During November, the

Question:

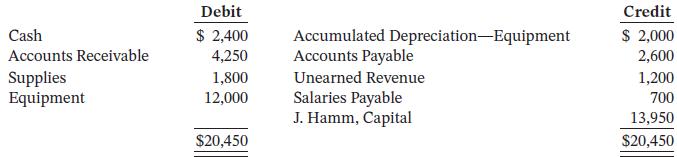

On October 31, 2024, the account balances of Hamm Equipment Repair were as follows.

During November, the following summary transactions were completed.

Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries.

10 Received $3,620 cash from customers on account.

12 Received $3,100 cash for services performed in November.

15 Purchased equipment on account, $2,000.

17 Purchased supplies on account, $700.

20 Paid creditors on account, $2,700.

22 Paid November rent of $400. 22 Paid salaries of $1,700.

27 Performed services on account and billed customers for these services, $2,200.

29 Received $600 from customers for future service.

Adjustment data consist of:

1. Supplies on hand, $1,400

2. Accrued salaries payable, $350

3. Depreciation for the month is $200

4. Services related to unearned revenue of $1,220 were performed during the month

Instructions

a. Enter the October 31 balances in the ledger accounts (use T accounts).

b. Prepare and post the November transaction entries.

c. Prepare a trial balance at November 30.

d. Prepare and post the adjusting entries for the month.

e. Prepare an adjusted trial balance.

f. Prepare an income statement and a statement of owner’s equity for November and a balance sheet as at November 30.

Taking It Further

On Hamm Equipment Repair’s trial balance, Accounts Payable is $2,600. After the adjusting entries have been posted, the balance in this account is still $2,600. Since there is no change, it is not necessary to include Accounts Payable on the adjusted trial balance. Do you agree? Why or why not?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak