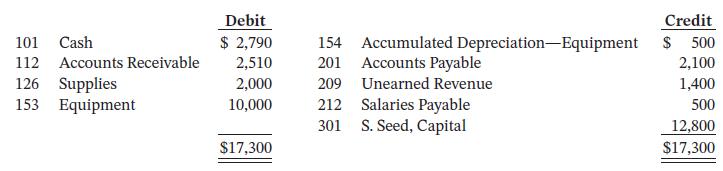

On October 31, 2024, the account balances of Pine Equipment Repair were as follows: During November, the

Question:

On October 31, 2024, the account balances of Pine Equipment Repair were as follows:

During November, the following summary transactions were completed.

Nov. 8 Paid $1,100 for salaries due employees, of which $500 is for November salaries.

10 Received $1,200 cash from customers on account.

12 Received $1,400 cash for services performed in November.

15 Purchased equipment on account, $3,000.

17 Purchased supplies on account, $500.

20 Paid creditors on account, $2,500.

22 Paid November rent of $300.

22 Paid salaries of $1,300.

27 Performed services on account and billed customers for services provided, $900.

29 Received $550 from customers for future service.

Adjustment data consist of:

1. Supplies on hand, $1,000.

2. Accrued salaries payable, $500.

3. Depreciation for the month is $100.

4. Services of $1,150 related to the unearned revenue were provided during the month.

Instructions

a. Enter the October 31 balances in the ledger accounts (use T accounts).

b. Journalize the November transactions.

c. Post the November transactions.

d. Prepare a trial balance at November 30.

e. Journalize and post adjusting entries.

f. Prepare an adjusted trial balance.

g. Prepare an income statement and a statement of owner’s equity for November and a balance sheet as at November 30.

Taking It Further

Comment on the company’s results of operations and its financial position. In your analysis, refer to specific items in the financial statements.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak