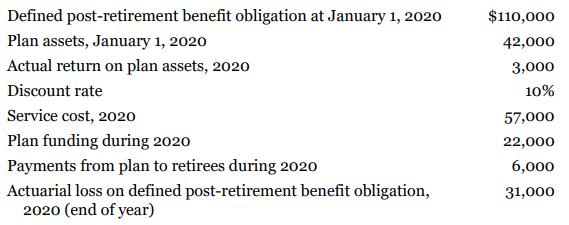

Rosek Inc. provides the following information related to its post-retirement health-care benefits for the year 2020: Rosek

Question:

Rosek Inc. provides the following information related to its post-retirement health-care benefits for the year 2020:

Rosek Inc. follows IFRS.

Instructions

a. Calculate the post-retirement benefit expense for 2020.

b. Calculate the post-retirement benefit remeasurement gain or loss—other comprehensive income (OCI) for 2020.

c. Determine the December 31, 2020 balance of the plan assets, the defined post-retirement benefit obligation, and the plan surplus or deficit.

d. Determine the balance of the net post-retirement benefit liability/asset account on the December 31, 2020 SFP.

e. Reconcile the plan surplus or deficit with the amount reported on the SFP at December 31, 2020.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy